Hi everyone,

Here's my situation. I've recently been let go from my job, and am considering using this as an opportunity for early retirement (I'm currently 51).

I've been tracking my financial metrics for a number of years now, and know that, assuming average returns, I would be alright.

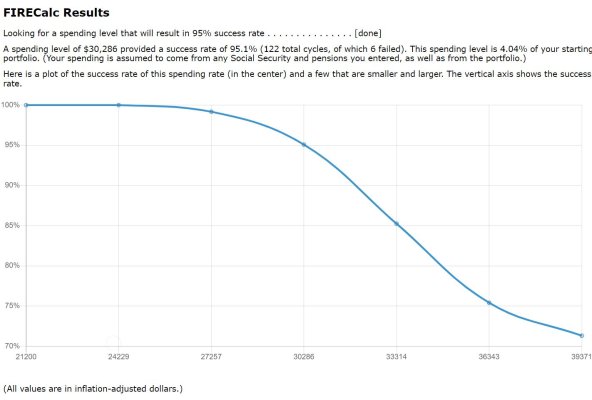

I entered my numbers in FireCalc and got a 75% chance of success (using the constant spending model), which seems riskier than I would like.

I then re-entered my info, this time excluding some of my discretionary expenses (I had $10,000 a year earmarked for travel), and got back a 100% success rate.

What I'm now wondering if there's a way to somehow run the numbers, assuming that if you fall a bellow a certain threshold, you could skip some discretionary expenses until you're back on track?

I looked at the other spending models, but neither seem to do what I want.

Here's my situation. I've recently been let go from my job, and am considering using this as an opportunity for early retirement (I'm currently 51).

I've been tracking my financial metrics for a number of years now, and know that, assuming average returns, I would be alright.

I entered my numbers in FireCalc and got a 75% chance of success (using the constant spending model), which seems riskier than I would like.

I then re-entered my info, this time excluding some of my discretionary expenses (I had $10,000 a year earmarked for travel), and got back a 100% success rate.

What I'm now wondering if there's a way to somehow run the numbers, assuming that if you fall a bellow a certain threshold, you could skip some discretionary expenses until you're back on track?

I looked at the other spending models, but neither seem to do what I want.