Deriving that risk-free rate isn't so simple, is it? I'd be happy to use the interest rate for I bonds, except that the current fixed interest rate is zero. I'd try it with TIPS, but their auctions don't always offer recent data since they don't match expected longevity.

Again, you wouldn't use an inflation-linked bond for a non COLAd annuity.

Like independent suggested, the way to think of the present value of a future cash flow is by pretending you had to buy that individual cash flow in the market. Whats the cheapest price you can find for that cash flow at the same level of credit risk?

Well, as a retail investor, its probably bank CD rates at the short end of the curve and treasurys at the long end. In other words, the cheapest seller of cash flows 1 or 2 years hence is probably an FDIC insured bank. The cheapest seller of cash flows 7-10 years out is probably the US treasury. For the typical retail investor's purposes, the credit risks are the same.

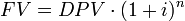

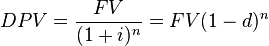

So the way you value a fixed annuity is by determining how much you'd have to pay to buy the individual cash flows in the marketplace. So you build a curve consisting of the best interest rates available to you (at that equivalent credit risk) and compute the discount factors from there - inflation doesn't come into play at all. (except indirectly of course since inflaiton expectations effect interest rates)

Of course in practice you get an incomplete set of data points across the term structure and have to do some interpolation between them.. but its entirely doable with some staightforward arithmetic.

Another factor is that an annuity without survivor options stops when the annuitant dies. When the owner of a portfolio of bonds dies, the heirs are still left with a portfolio of bonds. That has to affect the interest rate, although it's probably only relevant to the owner when he's setting things up. But leaving an inheritance has some definite value that would affect the discount factor.

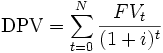

Yeah, if the payments are contingent on your survival that adds a second layer of complexity. The way we** handle this is not by adjusting the discount factor per say but by adjusting the future 'expected' payment amount before discounting.

For example, pretend you have a single payment of 1000 due to you in one year, if and only if you are alive at that time. Say that we consult the actuarial tables and determine that you have a 98.5% chance of being alive in one year. Therefore we consider the 'expected' payment amount to be $985. We would then discount the 985 back to today using the standard discounting curve I described above. You would continue that process with each future cash flow, using the appropriate 'survival probability' to compute the 'expected value' of each payment,

prior to discounting it back to today.

(That process is identical with the process for incorporating credit risk into the equation, its just tht the 'survival probablity' one uses for a corporate issuer is derived from CDS spreads not from actuarial tables)

** when I say 'we', I should point out that my day job is to build systems that value fixed income derivatives of all kinds - FX derivatives, interest rate products, credit derivatives, even various derivatives based on life insurance products