If I made any mistakes/left something out please let me know and I will do my best to edit this. Hopefully there is some discussion about long-term FIRE and maybe some portfolio construction stuff as well. Thanks!

I'm 37 and married with two children ages 10,11 and live in California. I've lurked on this forum and appreciated the insights and thought processes of many involved. I wanted to share my situation and general thoughts, partly to hold myself accountable for where I stand/think right now, but mostly to open my thoughts/portfolios up to suggestions or criticism from the minds of this forum.

I would love opinions/criticism on asset allocation/porfolio construction and future methodology, or anything else that might standout enough for you to comment.

Our current expenses are 13k/month, that includes everything. We can ratchet back if needed.

Our current balance sheet is as follows:

Taxable brokerage account: 2.8MM

Roth brokerage acct: 275k

Roth microcap hedge fund: 266k

Taxable microcap hedge fund: 757k

529 for 11 year old: 138k

529 for 10 year old: 134k

Traditional IRA husband 10k

traditional IRA wife 10k

treasury direct/paper bonds: 32k

private investments: 450k

Cash 325k

House value owned outright 1.1M

Some explanations and thoughts:

I'm a believer in minimizing cost, spending outsized effort on correct assett allocation, and tax efficiency. I do sometimes end up with an opinion and deviate from textbook strategy and in the past it has served me well. I think the time to begin to eliminate/minimize that personality trait might be now.

The hedge fun holding carries expensive fees. It is 1% of assets and 20% of profits in any year the benchmark 10% return is met. If there is no 10% return there is no performance fee. It is my belief that in this particular space of microcap stocks and special situations(mostly microcap arbitrage), this fund/manager adds the value to warrant the fees. The taxable portion is managed with tax efficiency in mind and the roth portion has a bit more freedom to make decisions not constrained by tax implications. I have held/added to this investment over the past 10 years and it has been a stellar performer.

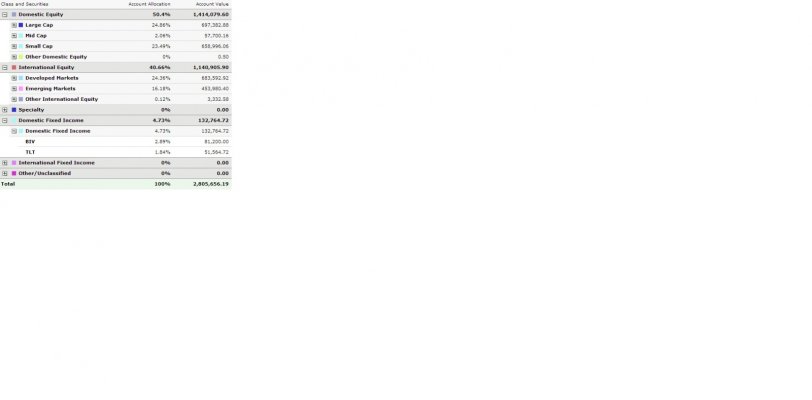

The asset allocation breakdown in my brokerage account is as follows (there is 110k cash in the account earmarked for bonds or TIPS in some way shape or form):

***attachment inserted for this, might sow at the bottom?****

I think we are probably overweight smallcap because of the hedge fund, slighty overweight emerging markets and underweight fixed income. We cannot change our asset allocations quickly without incurring tax gains because all of the stocks in my taxable accounts have gains. I recently turned off our DRIP program and plan to use the proceeds to continue to add to our Fixed income holdings. Additionally, we own 225k worth of NLY in my ROTH brokerage account, which can be considered a fixed income position, also owning our house outright has some of the diversification benefits of long fixed income (maybe?), and some of my "private investments" include notes with characterstics very similar to fixed income holdings.

Since we are young, the FIREd calc becomes a bit interesting, in my opinion anyways. At 65 we will receive a pension of 2,480/month and then at some point the two of us will get whatever social security is still available at that point (approx 30 years from now who knows what that will look like).

Our current income from non-investment activities is limited enough to consider zero.

I'm 37 and married with two children ages 10,11 and live in California. I've lurked on this forum and appreciated the insights and thought processes of many involved. I wanted to share my situation and general thoughts, partly to hold myself accountable for where I stand/think right now, but mostly to open my thoughts/portfolios up to suggestions or criticism from the minds of this forum.

I would love opinions/criticism on asset allocation/porfolio construction and future methodology, or anything else that might standout enough for you to comment.

Our current expenses are 13k/month, that includes everything. We can ratchet back if needed.

Our current balance sheet is as follows:

Taxable brokerage account: 2.8MM

Roth brokerage acct: 275k

Roth microcap hedge fund: 266k

Taxable microcap hedge fund: 757k

529 for 11 year old: 138k

529 for 10 year old: 134k

Traditional IRA husband 10k

traditional IRA wife 10k

treasury direct/paper bonds: 32k

private investments: 450k

Cash 325k

House value owned outright 1.1M

Some explanations and thoughts:

I'm a believer in minimizing cost, spending outsized effort on correct assett allocation, and tax efficiency. I do sometimes end up with an opinion and deviate from textbook strategy and in the past it has served me well. I think the time to begin to eliminate/minimize that personality trait might be now.

The hedge fun holding carries expensive fees. It is 1% of assets and 20% of profits in any year the benchmark 10% return is met. If there is no 10% return there is no performance fee. It is my belief that in this particular space of microcap stocks and special situations(mostly microcap arbitrage), this fund/manager adds the value to warrant the fees. The taxable portion is managed with tax efficiency in mind and the roth portion has a bit more freedom to make decisions not constrained by tax implications. I have held/added to this investment over the past 10 years and it has been a stellar performer.

The asset allocation breakdown in my brokerage account is as follows (there is 110k cash in the account earmarked for bonds or TIPS in some way shape or form):

***attachment inserted for this, might sow at the bottom?****

I think we are probably overweight smallcap because of the hedge fund, slighty overweight emerging markets and underweight fixed income. We cannot change our asset allocations quickly without incurring tax gains because all of the stocks in my taxable accounts have gains. I recently turned off our DRIP program and plan to use the proceeds to continue to add to our Fixed income holdings. Additionally, we own 225k worth of NLY in my ROTH brokerage account, which can be considered a fixed income position, also owning our house outright has some of the diversification benefits of long fixed income (maybe?), and some of my "private investments" include notes with characterstics very similar to fixed income holdings.

Since we are young, the FIREd calc becomes a bit interesting, in my opinion anyways. At 65 we will receive a pension of 2,480/month and then at some point the two of us will get whatever social security is still available at that point (approx 30 years from now who knows what that will look like).

Our current income from non-investment activities is limited enough to consider zero.