Now to the 90+% stock allocation. I think you are completely crazy unless you plan on going back to work. Take $5m as the portfolio. That gives you in excess of $4.5m in stock type investments (I don't think you can count your position in NLY as a bond-like investment). Five years ago in the last crash you would have seen that position reduced by approximately 50%. Yes, you would lose $2.25m. That would leave you with $2.75m of which a draw of $156k pa would constitute almost 5.7%. You can draw less but even a 4% withdrawal on the reduced stash would only be $110k. Do you really want to go this low? I repeat, you have won the game. Look at reducing your stock allocation to at most between 50-60%. You should be investing with the mentality of a 57 year-old.

I respectfully disagree with your sentiments of having 90% stock allocation as crazy.

Don't forget that even the S&P 500 ETF currently yields just over 2%, so it wouldn't take a giant effort to get an average yield on your portfolio close to 3% and have it grow over time.

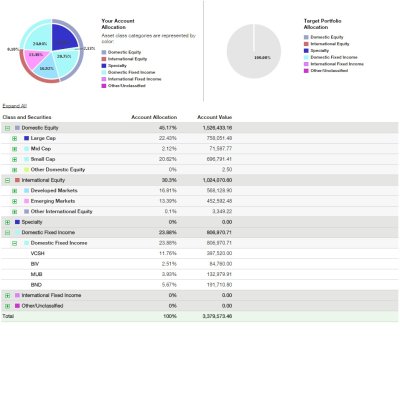

I'm 36, hoping to retire at some point over the next 10 years, and plan on a SWR of sub 3%. I am currently about 86% equities and 14% 'fixed income', with an overall portfolio yield of 4.2%. (I'm hoping to be able to live off of <3%, so my excess yield will simply reinvest and provide additional safety factor).

The equities portion has a decent international/emerging market component for capital growth, along with some MLPs, REITs, and BDCs to juice up the yield AND have some decent dividend growth.

The fixed income is 1/3 in I-bonds with an average fixed rate of 3.3%, and 2/3 in mostly preferred stocks with an average current yield of of 7.4%.

Based on my portfolio, I don't need to consume my portfolio to live off of, so I'm not uneasy with 86% of it in equities. If the market drops 50% again, I'm sure some companies will cut their dividends...but I'm not expecting a 50% slash in dividends. And even if that were to happen - those I-bonds will come in handy to supplement things for a few years.

Yes, I realize that the preferred stocks are flat with their coupons, but they have a high enough yield to spin off income while the capital growth part of my portfolio grows over time, and will allow me to (eventually) sell off a little bit of that if need be to add to fixed income.

So, perhaps over time I will naturally increase my bond holdings, but I'm not seeing myself jumping up to a 50% fixed income allocation - unless I were in my 70s, rates were 6%-8%, and I only needed 2% to live off of.