Admitedly, this snapshot ends with gold at near inflation adjusted highs, so take it with a grain of salt. But I think there might be a use for gold. At least more than a plaything.

Mostly my comment was about the widely held belief that gold is an inflation hedge and/or a store of value. It isn't good at either in any useful way.

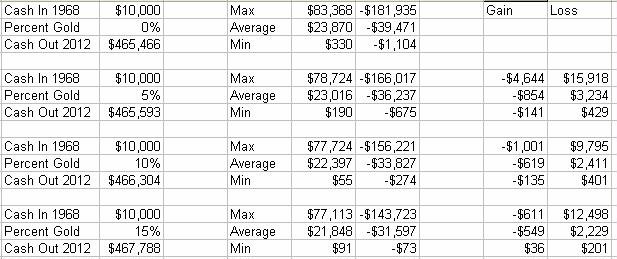

But it is still possible, as you point out, that an asset class can benefit a portfolio even if it isn't necessarily something you'd want to own as a stand alone investment. It doesn't have to be either of the above two things to be a valuable addition to a portfolio. The conditions to make this work are 1) its returns should not correlate highly with your other assets 2) its expected returns must be positive.

Do these conditions apply to gold today?

Low correlation is probably true, but what about expected positive returns now that gold is trading at an all-time high?

If you look at your calculation in the same way you'd look at a FIRECalc run, and if you were trying to determine the right allocation of gold in your portfolio, do you think the proper starting date for the analysis is 1968, when the price stood at $39 and was just about to embark on a 13 year bull-run that generated 23% average annual returns? Or, considering that gold is in the midst of a current 10 year bull-market that generated average annual returns of 19%, that maybe a better historic starting point for the analysis is closer to 1980.

What I see when I look at the price of gold over the last half century is an asset class that does tremendously well for about a decade and then does horrible for two. If we're using history as a guide (understanding that past performance is no guarantee) now seems like a very, very risky time to own gold; for any reason.