Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

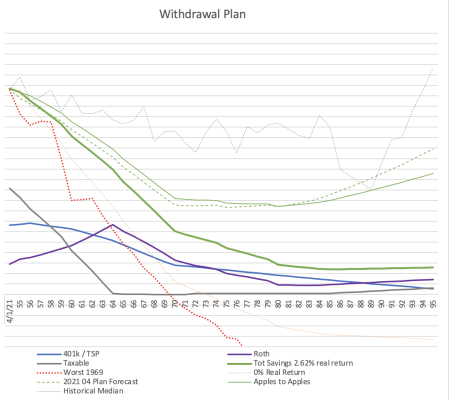

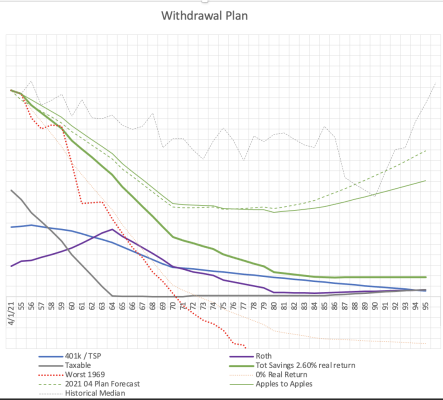

Discovery of Firecalc, Fidelity and a few other retirement calculators allowed me to feel comfortable in retiring at 57.

I did shoot for a score of 100 in Fidelity at the Significantly Below Average module, plus 100% in Firecalc.

However I do use a true expense budget with no artificial fluff in the numbers, plus using SS with no haircut, so 100% was important to me, as am partially dependent on the portfolio throughout retirement.

I did shoot for a score of 100 in Fidelity at the Significantly Below Average module, plus 100% in Firecalc.

However I do use a true expense budget with no artificial fluff in the numbers, plus using SS with no haircut, so 100% was important to me, as am partially dependent on the portfolio throughout retirement.