Among_Primates

Dryer sheet wannabe

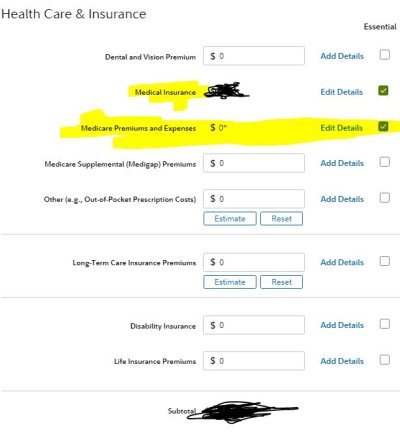

I'm semi-retired now, at 90%. I'm 66, and health and time won't allow me to stay on the treadmill till 100%. I'm going to trigger a non-COLA pension in a year (already taken into consideration in the 90%).

Of course, if I change the inflation option to 7%, my results drop to 6.6%.

Of course, if I change the inflation option to 7%, my results drop to 6.6%.