You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How many years did it take for your 401k to hit 1 million ?

- Thread starter targatom2019

- Start date

Started work in 1984 but didn't start contributing to a 401K until probably around 87 or 88. Probably started a taxable account about that time. By 1990 I was maxing out 401K's. First time I hit $1M was 2007. Then again in 2010 post-recovery. Combination of 401K, Rollover IRA, Deferred Compensation, HSA, Taxable accounts.

Funding has come from:

Paycheck Withholdings (401K, rollover IRAs, Deferred Compensation, HSA)

Company Match/Special Bonus program for some 401Ks

Direct savings from my paycheck to my taxable accounts.

ESPP, Stock Options, RSU's and Bonuses to my taxable accounts.

Severance Packages when I've been unfortunately/fortunately layed off.

Funding has come from:

Paycheck Withholdings (401K, rollover IRAs, Deferred Compensation, HSA)

Company Match/Special Bonus program for some 401Ks

Direct savings from my paycheck to my taxable accounts.

ESPP, Stock Options, RSU's and Bonuses to my taxable accounts.

Severance Packages when I've been unfortunately/fortunately layed off.

There is more joy on ER over a sinner who repents

I don't remember exactly when, but it was something north of 30 years. I got off to a slow start, didn't max it out until late in the game, and generally made every possible investment blunder at least once. If you're seeking the poster boy for How To Do It Wrong, you need look no further.

DW and I married young, started having kids quickly, and had a bunch (5) of them. Children are Lamborghinis: they can outrun you easily, they test your skills every second and they're very expensive, although if you can afford them it's worth it.

Consequently, some years I couldn't spare the cash to contribute enough for the full company match. Oh, well. Family needs superseded my retirement dreams, and I don't second-guess that decision.

I toggled between investment extremes - and always at the wrong times -either the low-risk Stable Value option or the high-risk Small Caps and International Fund options. I took out loans to replace heat pumps and roofs. At one time, there was even an option to direct my savings into company stock and take delivery of the shares, which I then sold to fund car repairs.

Some might think it embarrassing to confess such a large basket of ER errors, but not me. Au contraire; I'm a good example that it's time and persistence, not timing or cleverness, that builds financial security.

Eventually, after about 20 years, I did get serious about retirement prep and did two things correctly:

1) With every salary increase I boosted the automatic deductions from my paycheck so it went right into the account without it ever crossing my hands, and

2) stuck with an allocation so it could compound undisturbed. It usually compounded slowly, but it compounded nonetheless.

Of course, had I maxed it out from day 1, resisted the harebrained DMT attempts, and never tapped it, it would be 2-3X larger today. But it's enough, and as Mary Poppins reminds us "Enough is as good as a feast".

Now, when fresh faces appear on this forum, distraught over thinking they've been idle too long and RE will be unattainable, I can honestly reassure them that it's never too late to get on the right track. Just look at me.

I don't remember exactly when, but it was something north of 30 years. I got off to a slow start, didn't max it out until late in the game, and generally made every possible investment blunder at least once. If you're seeking the poster boy for How To Do It Wrong, you need look no further.

DW and I married young, started having kids quickly, and had a bunch (5) of them. Children are Lamborghinis: they can outrun you easily, they test your skills every second and they're very expensive, although if you can afford them it's worth it.

Consequently, some years I couldn't spare the cash to contribute enough for the full company match. Oh, well. Family needs superseded my retirement dreams, and I don't second-guess that decision.

I toggled between investment extremes - and always at the wrong times -either the low-risk Stable Value option or the high-risk Small Caps and International Fund options. I took out loans to replace heat pumps and roofs. At one time, there was even an option to direct my savings into company stock and take delivery of the shares, which I then sold to fund car repairs.

Some might think it embarrassing to confess such a large basket of ER errors, but not me. Au contraire; I'm a good example that it's time and persistence, not timing or cleverness, that builds financial security.

Eventually, after about 20 years, I did get serious about retirement prep and did two things correctly:

1) With every salary increase I boosted the automatic deductions from my paycheck so it went right into the account without it ever crossing my hands, and

2) stuck with an allocation so it could compound undisturbed. It usually compounded slowly, but it compounded nonetheless.

Of course, had I maxed it out from day 1, resisted the harebrained DMT attempts, and never tapped it, it would be 2-3X larger today. But it's enough, and as Mary Poppins reminds us "Enough is as good as a feast".

Now, when fresh faces appear on this forum, distraught over thinking they've been idle too long and RE will be unattainable, I can honestly reassure them that it's never too late to get on the right track. Just look at me.

...Some might think it embarrassing to confess such a large basket of ER errors, but not me. Au contraire; I'm a good example that it's time and persistence, not timing or cleverness, that builds financial security.

.....

Now, when fresh faces appear on this forum, distraught over thinking they've been idle too long and RE will be unattainable, I can honestly reassure them that it's never too late to get on the right track. Just look at me.

Love this. Thanks for sharing. Your experience likely makes you a more compassionate person, as well. [emoji1360]

Lawrencewendall

Full time employment: Posting here.

Now, when fresh faces appear on this forum, distraught over thinking they've been idle too long and RE will be unattainable, I can honestly reassure them that it's never too late to get on the right track. Just look at me.

Not mine

When's the best time to plant a tree? 20 years ago.

When's the second best time? Today.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It took 20 years.

In the past couple of years I dug through all my investment records and summarized. I learned a few things I have forgotten.

The first few years I was invested in bond funds! This shocked me but after reflecting on it, I remember my philosophy was based on "safety" since these were retirement funds. 401(k) was new, it was replacing pensions so I reasoned that bonds were the way to go. It took a bit of self-education to understand that I need to be invested in equities as a young guy, and I did switch pretty quickly. To that point no one had ever taught me anything about investing.

No sure when i began maxing out fully but I could figure that out too. I know that plans have gotten worse for me over time. At first, I had a middle of the road company match and even a "profit sharing" contribution by the company. That probably was only a couple of years. Then profit sharing went away, and then so did the match (this was over 3 different employers). Now I have not had a company-matched 401K in over 20 years!

Good news is I got into the habit of tax-deferred saving early and worked to max it out (so painful at first). The other thing i did which helped my overall saving was I bought a house a year out of college so I was building equity and keeping taxes low. That is a whole 'nother story but one that worked out.

My son is investing in both taxable and outside of tax deferred vehicles and it is all equities right from the jump. He DID get some education about investing. So great to prepare our kids.

In the past couple of years I dug through all my investment records and summarized. I learned a few things I have forgotten.

The first few years I was invested in bond funds! This shocked me but after reflecting on it, I remember my philosophy was based on "safety" since these were retirement funds. 401(k) was new, it was replacing pensions so I reasoned that bonds were the way to go. It took a bit of self-education to understand that I need to be invested in equities as a young guy, and I did switch pretty quickly. To that point no one had ever taught me anything about investing.

No sure when i began maxing out fully but I could figure that out too. I know that plans have gotten worse for me over time. At first, I had a middle of the road company match and even a "profit sharing" contribution by the company. That probably was only a couple of years. Then profit sharing went away, and then so did the match (this was over 3 different employers). Now I have not had a company-matched 401K in over 20 years!

Good news is I got into the habit of tax-deferred saving early and worked to max it out (so painful at first). The other thing i did which helped my overall saving was I bought a house a year out of college so I was building equity and keeping taxes low. That is a whole 'nother story but one that worked out.

My son is investing in both taxable and outside of tax deferred vehicles and it is all equities right from the jump. He DID get some education about investing. So great to prepare our kids.

I did a rough calculation: 19000/yr contribution + 5000/yr employer match @ 5% return (assuming 0% inflation all years for simplicity) gives a $1m balance around 23 years. At a 7% return that goes down to 20 years.

I work with a guy whose 401k balance is just under $3m, but he's maxed it out his entire career and he is still working in his late 60s. Obviously not someone you'd find on this forum LOL.

I work with a guy whose 401k balance is just under $3m, but he's maxed it out his entire career and he is still working in his late 60s. Obviously not someone you'd find on this forum LOL.

teejayevans

Thinks s/he gets paid by the post

- Joined

- Sep 7, 2006

- Messages

- 1,692

Never did, and I maxed out every year. But it wasn’t until last few years when raised the contribution limits. Don’t know if it was limited before by fed or corporate executives.

W2R

Moderator Emeritus

+1Never did, and I maxed out every year. But it wasn’t until last few years when raised the contribution limits. Don’t know if it was limited before by fed or corporate executives.

Same here. I maxed out my TSP contributions and Roth IRA contributions every year, but the contribution limits for both were ridiculously low. Therefore, every year after maxing out my TSP and Roth IRA, I put as much as I possibly could into taxable Vanguard accounts, several times as much as I was permitted to put into tax sheltered accounts.

Consequently, most of my investments are taxable. If I hadn't put money into taxable accounts, I could not have retired when I did.

JustCurious

Thinks s/he gets paid by the post

- Joined

- Sep 20, 2006

- Messages

- 1,396

I would like to play, but I don't have a 401k, never have.

Nature Lover

Recycles dryer sheets

I never reached $1M in my retirement accounts; but I did in taxable. If I count my pensions as retirement account equivalents, I suspect it took 20+ years, as the real value is earned closer 25-30 yrs in. .

I started seriously saving at age 27. Maxed out my tax deferred accounts as well as pre-paid mortgage, etc. When I got married the second time, I had low $300K in assets and now-ex-husband had <$60K and I had a nearly paid off house in CA. When we got divorced 2.5 years ago, he walked away with low 7 figures as well as I and I got the paid off house in a new location (see what I came in with above). He also has a military pension worth low 7 figures as an annuity and I will have one that is a bit less than his when I turn 60 in 5 years.

We both worked at jobs where we made high 5+ to low 6+figures - and he was paying child-support and alimony-house payments for his ex for half of our marriage.

So, it is doable.....I really worked on minimizing our expenditures (defense) over those years although we did enjoy ourselves traveling. I also consider myself fortunate that I stayed in the Reserves as long as I did as well as majored in engineering...two decisions that have stood me well in my financial life journey.

We both worked at jobs where we made high 5+ to low 6+figures - and he was paying child-support and alimony-house payments for his ex for half of our marriage.

So, it is doable.....I really worked on minimizing our expenditures (defense) over those years although we did enjoy ourselves traveling. I also consider myself fortunate that I stayed in the Reserves as long as I did as well as majored in engineering...two decisions that have stood me well in my financial life journey.

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

I contributed to my 401k for 20 years at about 23% of my pay. I have been retired 18 months (and have not withdrawn any). The balance is $890k as of yesterday. It’ll probably make it to a million before I start withdrawing.

Never saw the magical 2 commas in my 401k, but except for the 7 years of Roth contributions, all the money in my IRAs is from yearly rollovers from my 401k, much of which was entirely after tax contributions to my 401k. If I add the taxes back in to my Roth and add the IRAs to existing 401k and subtract out Roth contributions, it took about 14 years to hit a mil from the last time it was zero. The zero (negative, actually) was thanks to the QDRO from last divorce in 1994. Took about 5 years to get back up to zero. Was worth every penny. But if you count from when I first had a 401k (and I have always had one since 1985), then it took all of 30 years to get there.

Last edited:

lemming

Full time employment: Posting here.

- Joined

- May 29, 2008

- Messages

- 600

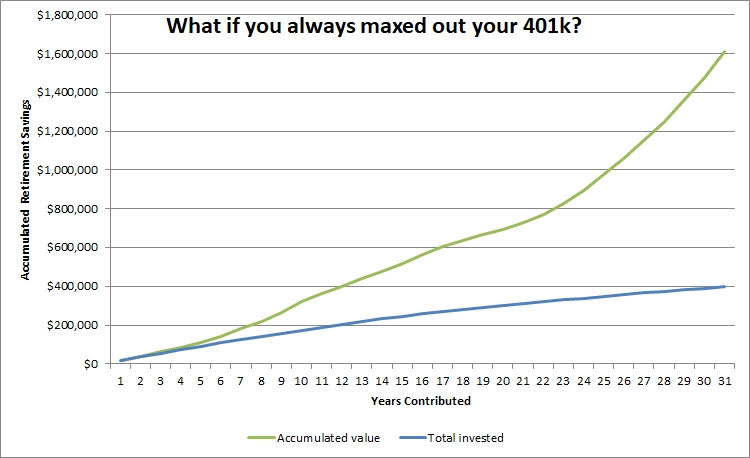

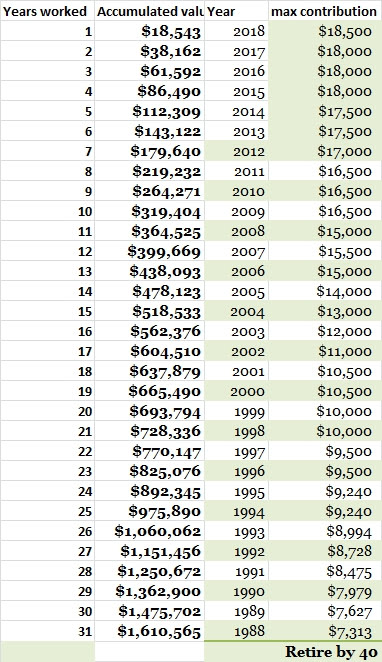

Why are the years backwards to the accumulation numbers and why did the numbers never go down?Here is how to read this graph.

The horizontal axis is how many years you have been working.

The green line is how much your 401(k) would be worth if you maxed out every year.

The blue line is how much you have contributed.

Note: In our scenario, I have our worker contribute the max contribution divided by 12 every month. To make it simple, we’ll invest in VFINX, the Vanguard S&P 500 index fund.

Assumptions are in this link:

https://retireby40.org/what-if-always-maxed-401k/

Took almost 18 seconds to do a google search.

Rustic23

Thinks s/he gets paid by the post

I vote Never too.

SecretlyFI

Recycles dryer sheets

- Joined

- Dec 8, 2012

- Messages

- 164

25 years, 1993-2018. Maxed all years after the first few, 3% match.

I agree with the point about paying attention to after tax to maximize your ability to retire early and to provide withdrawal options.

My 401k and after tax balances are about equal at this point.

I agree with the point about paying attention to after tax to maximize your ability to retire early and to provide withdrawal options.

My 401k and after tax balances are about equal at this point.

Bamaman

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Most of my 36 years working was as a Ford Employee.

They started off with a 401K in Ford Stock--not the best performing stock. I bailed out of it as soon as possible at a high point. We also had one of the best defined pension funds in the country--with incredible investments according to actuaries. (We also enjoyed those $5 deductible doctors' visits and $2 prescriptions in those years.)

Then the defined pension fund was stopped for new employees. They only have 401Ks for pensions.

Our Fidelity funds were diversified enough to where we could get in on some high performers and some "safer" performing mutual funds. Then they let us choose our own portfolios if we paid the charges, and that's when I made my money.

My wife turned 70 last June, and is having to take 2 years' RMDs this year--by 4/1/2019 and 12/31/2019. In 2 years, I'll have to start drawing substantial RMDs. The problem is we don't need the money with no debts and no "wants". I'll withdraw 4% of the funds, have taxes taken out and put the money back into the same diversified Fidelity accounts after taxes.

My long term financial plan was executed since 1972, and time was my ally. Compound interest also did me well as did paying close attention to the available 401K mutual funds that remain diversified to this day.

They started off with a 401K in Ford Stock--not the best performing stock. I bailed out of it as soon as possible at a high point. We also had one of the best defined pension funds in the country--with incredible investments according to actuaries. (We also enjoyed those $5 deductible doctors' visits and $2 prescriptions in those years.)

Then the defined pension fund was stopped for new employees. They only have 401Ks for pensions.

Our Fidelity funds were diversified enough to where we could get in on some high performers and some "safer" performing mutual funds. Then they let us choose our own portfolios if we paid the charges, and that's when I made my money.

My wife turned 70 last June, and is having to take 2 years' RMDs this year--by 4/1/2019 and 12/31/2019. In 2 years, I'll have to start drawing substantial RMDs. The problem is we don't need the money with no debts and no "wants". I'll withdraw 4% of the funds, have taxes taken out and put the money back into the same diversified Fidelity accounts after taxes.

My long term financial plan was executed since 1972, and time was my ally. Compound interest also did me well as did paying close attention to the available 401K mutual funds that remain diversified to this day.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

... My wife turned 70 last June, and is having to take 2 years' RMDs this year--by 4/1/2019 and 12/31/2019. In 2 years, I'll have to start drawing substantial RMDs. The problem is we don't need the money with no debts and no "wants". I'll withdraw 4% of the funds, have taxes taken out and put the money back into the same diversified Fidelity accounts after taxes...

It's alright. Now that Uncle Sam has gotten his cut, the rest is all yours, even if a bit diminished. You can spend it or not, but that burden is done with.

- Joined

- Jul 1, 2017

- Messages

- 5,833

I don't remember exactly when, but it was something north of 30 years. I got off to a slow start, didn't max it out until late in the game, and generally made every possible investment blunder at least once. If you're seeking the poster boy for How To Do It Wrong, you need look no further.

DW and I married young, started having kids quickly, and had a bunch (5) of them. Children are Lamborghinis: they can outrun you easily, they test your skills every second and they're very expensive, although if you can afford them it's worth it. :)

Consequently, some years I couldn't spare the cash to contribute enough for the full company match. Oh, well. Family needs superseded my retirement dreams, and I don't second-guess that decision.

I toggled between investment extremes - and always at the wrong times -either the low-risk Stable Value option or the high-risk Small Caps and International Fund options.

Yep, I had a fleet of Lamborghinis myself; and a similar investment acumen!

Yes, I also wish I had realized the intelligent decision to switch from tax deferred savings & 401k over to after tax, earlier so I had a better balance. About 65% of mine is pre tax, and much of that was tax deferred at a lower rate than what I will always pay the rest of my life. Until about 15 -20 years ago, I assumed pensions did not count towards income, for determining taxes paid on SS, and that SS was tax free. Having $1M in pretax accounts is not as satisfying as $850k in after tax accounts would be!

Last edited:

ls99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 2, 2008

- Messages

- 6,509

Never. Do have all the comforts I need.

Another member of the Not Me club. I did not have a 401K option until late 30's. Didn't start maxing out until my 50's. DW was SAHM, so income and portfolio was always solo (or maybe acapella?).

That's okay. Put my (career) feet up at 60. Our "stash," a couple of modest pensions, and decent retiree health insurance makes us golden (by our yardstick). YMMV!

I am with you, started late with 401k’s. We did hit 1M yesterday between 401k’s and cash. However, We do have over 100k combined annual pensions not counting SS....Golden!

Last edited:

We never did. First off, the companies we worked for didn't even have them early on. So we contributed to our IRA accounts. Then, finally we worked for companies that had them but it was later in life. We contributed enough to get the match but couldn't afford more. But we also contributed more to our IRA's and eventually to our Roth IRA's once they came out.

Even now, in our 60's between 401k's and IRA's we are still shy of a million.

But- I did also inherit and IRA and some money to put in a brokerage account and emergency fund. Plus saved some cash. All in all still under 2 million. I stopped working in Sept at age 62 due to a management changer over and my husband is trying to stick it out at work until next spring at age 66. But I doubt we will get to 2 million ever.

Even now, in our 60's between 401k's and IRA's we are still shy of a million.

But- I did also inherit and IRA and some money to put in a brokerage account and emergency fund. Plus saved some cash. All in all still under 2 million. I stopped working in Sept at age 62 due to a management changer over and my husband is trying to stick it out at work until next spring at age 66. But I doubt we will get to 2 million ever.

Is it even possible to hit over 1 million without 25+ years of maxing? I dont know what it used to be...but recently it was $17,000, then $17,500...now its $18,000 I believe.

Its a lot of money per year...but not that much in terms of reaching 1,000,000. Even when the markets are insanely bullish...it takes a long time to get there.

That depends on the rate of return. The market has had a great run over the last 10 years. I have some options that have returned 15% annually for the last 8 years. It makes a big difference.

Similar threads

- Replies

- 0

- Views

- 218

- Replies

- 192

- Views

- 12K