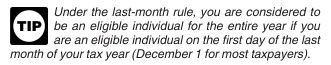

My new ACA plan will be a HSA approved account. Have been doing some research on them and looks like a good idea to me. What I am a little confused about is what they call a time test. It looks like for me to be eligible I have to be in the plan for a full year and for the rest of the month of the following year that I sign up. In other words if I become eligible on January 3, 2018 then I would still have to be in the plan on January 31, 2019. The problem becomes that my ACA plan could change in 2019 and I would be in another plan that was not a HSA. Am I correct in my understanding of this?