You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I finally FIRED today - Got my last paycheck

- Thread starter cyber888

- Start date

Zona

Recycles dryer sheets

- Joined

- Apr 26, 2013

- Messages

- 208

Congratulations! Enjoy your time and your freedom!

Hello from Ohio, I was actually forced into FIRE due to being caught on a hot mic in a large mtg (long story) back in Nov 2022. I had just turned 60 in Oct. I lost my healthcare and not a penny of Ohio Unemployment. Turned down due to "just cause" I paid into that damn fund for 40 yrs and never asked for a nickel until losing my job. Anyway, was curious what your doing for Healthcare? Thanks god I picked up a policy after being dropped from where I worked.

Dean56

Recycles dryer sheets

- Joined

- Aug 31, 2018

- Messages

- 265

Congratulations!! Have you stopped smiling yet? Probably not. Enjoy the next chapter in your life.

Hello from Ohio, I was actually forced into FIRE due to being caught on a hot mic in a large mtg (long story) back in Nov 2022. I had just turned 60 in Oct. I lost my healthcare and not a penny of Ohio Unemployment. Turned down due to "just cause" I paid into that damn fund for 40 yrs and never asked for a nickel until losing my job. Anyway, was curious what your doing for Healthcare? Thanks god I picked up a policy after being dropped from where I worked.

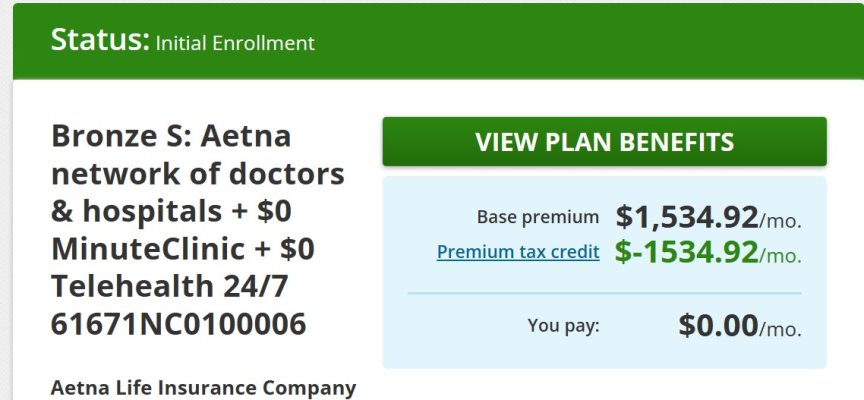

Thanks guys. I immediately enrolled in ACA and am paying $0.00 on my premium for a Bronze. Just go to Healthcare.gov. I earned around $62K for half a year, so that's the income I put in my application. It was approved and I got the Aetna Bronze. See attachment.

Attachments

Congratulations!! Have you stopped smiling yet? Probably not. Enjoy the next chapter in your life.

Yeah Dean, just smiling everyday.

Been so stress free and relaxed.

But I make it a point to exercise 30 - 60 minutes a day, then I can afford to couch potato and still lose weight.

I'm joining the Retired club also this month. I think 2 more paychecks from my company before Pension starts in August. I feel very calm and ready for it.

Today, someone at our beach club called me a PHD (I have no doctorate degree) meaning that group of grandparents like me...."Pop-pop (or papa) Has Dough". LOL

Congratulations to all the other recent retirees!

Haha. I do have a PhD but now I will use this new meaning to that.

Tracer

Recycles dryer sheets

I lost my job in my late 50's with far less than 7 figures. It was scary. But with a little part time work, a lifetime of saving, some good investing and a little inheritance, I made it through that tough time. Having virtually zero debt (house, car, etc.) at this stage of my life made a huge difference. I purchased some lifetime annuities as well as taking SS at 62. Those gave me a steady income stream as long as I live. With investment gains, today at 74 I now have well into 7 figures in IRA's, other holdings and a decent income to cover basic expenses. It's not all doom and gloom if you loose your job close to retirement if you plan things right. I'm feeling pretty good about the future.

My advice to all nearing retirement is to pay down debt as much as you can. If the worst happens, you won't have that to worry about and hamper your efforts to achieve a comfortable retirement.

My advice to all nearing retirement is to pay down debt as much as you can. If the worst happens, you won't have that to worry about and hamper your efforts to achieve a comfortable retirement.

Last edited:

Markola

Thinks s/he gets paid by the post

^^^ Tracer, Great story about flexibility, courage and pulling the levers you have toward a successful outcome.

House Divided

Dryer sheet aficionado

I love it when a plan comes together!

ychuck46

Recycles dryer sheets

Welcome to the Club

Wife retired at 56 and I joined her four years later at 60. Similar circumstances as you posted financially. After ten years in I can assure you that retirement is a blast. Best wishes.

Wife retired at 56 and I joined her four years later at 60. Similar circumstances as you posted financially. After ten years in I can assure you that retirement is a blast. Best wishes.

Thank you for the reply. I picked up a nice Anthem policy for $670 a month. Can you explain the tax credit? That makes its look like your monthly healthcare policy cost is zero?

Thanks!

Yes, $0.00 .. that's the ACA subsidy Tax credit. It's for me and DW. 2 persons get a bigger subsidy.

Last edited:

Congrats Tracer on how you survived those difficult times.

I'm purchasing a joint lifetime annuity now at 7.12% rate so that will go a long way, since I have no pension. Last month it was 6.9%, so its the right time to get this annuity. With SS and this annuity, we'll be getting around $5000/month income.

I'm purchasing a joint lifetime annuity now at 7.12% rate so that will go a long way, since I have no pension. Last month it was 6.9%, so its the right time to get this annuity. With SS and this annuity, we'll be getting around $5000/month income.

I lost my job in my late 50's with far less than 7 figures. It was scary. But with a little part time work, a lifetime of saving, some good investing and a little inheritance, I made it through that tough time. Having virtually zero debt (house, car, etc.) at this stage of my life made a huge difference. I purchased some lifetime annuities as well as taking SS at 62. Those gave me a steady income stream as long as I live. With investment gains, today at 74 I now have well into 7 figures in IRA's, other holdings and a decent income to cover basic expenses. It's not all doom and gloom if you loose your job close to retirement if you plan things right. I'm feeling pretty good about the future.

My advice to all nearing retirement is to pay down debt as much as you can. If the worst happens, you won't have that to worry about and hamper your efforts to achieve a comfortable retirement.

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,566

You're a role model that proves what can be done with planning, hard work and self discipline.

I'm a firm believer that people make their own luck.

You won!

I agree with that statement very much.

breakaway

Confused about dryer sheets

- Joined

- Dec 30, 2022

- Messages

- 2

Congratulations. Enjoy it all.

Shinge1233

Dryer sheet wannabe

Congratulations

Do you use 4%rule? How much you spend annually? And how much retirement income you have annually?

Do you use 4%rule? How much you spend annually? And how much retirement income you have annually?

ychuck46

Recycles dryer sheets

Do you use 4%rule? How much you spend annually? And how much retirement income you have annually?

I have always used the 4% rule as a worst case scenario for us. Wanted to fall under that in retirement and have been successful at doing so. In any given year, without any extraordinary expenses that might pull down our cash, we generally spend 2-2.5%. Since we usually do better than that on investments we don't expect to run out of money. And if we leave a decent haul to our daughter and SIL? There are a lot worse things in life.

As for actual financial numbers I steer away from giving out any figures. Others might care to do so but I am leery whenever such questions get asked on forums.

I agree with that statement very much.

Thanks Stormy & Street.

You guys are great too.

Do you use 4%rule? How much you spend annually? And how much retirement income you have annually?

I think in 2024 and 2025, I will be getting 4.5% - 5% to beef up cash before getting SS.

Because when DW and I get our Social Security in 2026, our withdrawal will be down to 2.0%, since Social Security income counts towards MAGI for the Affordable Care Act (ACA) income calculations. I'm still not covered for Medicare at 62 years old. So we have to be careful not to bump up our healthcare insurance by withdrawing more than we need from our pre-tax nest egg. This year - I'm pay $0.00 for our ACA healthcare.

Then, when I hit 65 years old and getting Medicare, we can bump up our withdrawal to 3% - 3.5%, maybe even blow the dough on a new car.

Our fixed retirement income in 2026 when we take SS + an annuity will be $5000/month. We'll have no mortgage, no car loans, no debt. Since we live in the South, we're in a low cost area.

And if we withdraw an additional $12000 from our retirement savings, then our income will be $6000/month or $72,000 per year, and we'll still be fine for 40 years (according to Firecalc). Right now, we can live on $4,500/month and still travel to Europe. We don't eat out much (maybe once or twice a month tops), as we try to eat healthy and we make our own Keto and organic meal. We even make our own Keto extra-low carb Pizza every week, as we have a lot of time on our hands. But we eat high protein food like steak. I just got Rib-eye steaks for $7.99/lbs. last Independence day.

Last year, I bought a high definition 4K high-end Sony TV that is 85 inches, so we don't go to the movies except maybe 2-3 blockbuster movies a year. We just enjoy what is streaming on TV.

Last year, I bought a high definition 4K high-end Sony TV that is 85 inches, so we don't go to the movies except maybe 2-3 blockbuster movies a year. We just enjoy what is streaming on TV.I also save about $280/month by mowing the lawn myself. All my neighbors are spending $260-$300/month on lawn mowing, but not me. I just LOVE mowing the lawn for my exercise. Been doing it for 25 years and I'm not stopping until I'm 90 years old. My neighbors are gaining weight, and I'm still fit and can run 5 miles straight with no problem.

Last edited:

Shinge1233

Dryer sheet wannabe

I think in 2024 and 2025, I will be getting 4.5% - 5% to beef up cash before getting SS.

Because when DW and I get our Social Security in 2026, our withdrawal will be down to 2.0%, since Social Security income counts towards MAGI for the Affordable Care Act (ACA) income calculations. I'm still not covered for Medicare at 62 years old. So we have to be careful not to bump up our healthcare insurance by withdrawing more than we need from our pre-tax nest egg. This year - I'm pay $0.00 for our ACA healthcare.

Then, when I hit 65 years old and getting Medicare, we can bump up our withdrawal to 3% - 3.5%, maybe even blow the dough on a new car.

Our fixed retirement income in 2026 when we take SS + an annuity will be $5000/month. We'll have no mortgage, no car loans, no debt. Since we live in the South, we're in a low cost area.

And if we withdraw an additional $12000 from our retirement savings, then our income will be $6000/month or $72,000 per year, and we'll still be fine for 40 years (according to Firecalc). Right now, we can live on $4,500/month and still travel to Europe. We don't eat out much (maybe once or twice a month tops), as we try to eat healthy and we make our own Keto and organic meal. We even make our own Keto extra-low carb Pizza every week, as we have a lot of time on our hands. But we eat high protein food like steak. I just got Rib-eye steaks for $7.99/lbs. last Independence day.Last year, I bought a high definition 4K high-end Sony TV that is 85 inches, so we don't go to the movies except maybe 2-3 blockbuster movies a year. We just enjoy what is streaming on TV.

I also save about $280/month by mowing the lawn myself. All my neighbors are spending $260-$300/month on lawn mowing, but not me. I just LOVE mowing the lawn for my exercise. Been doing it for 25 years and I'm not stopping until I'm 90 years old. My neighbors are gaining weight, and I'm still fit and can run 5 miles straight with no problem.

Hi cyber888, I am planning to retire at 58 too. Actually 4 years from today. When I reach 58, I will have full coverage insurance of medical, $7200 / month pension, $2300 / month 401k withdraw (4% rule), and no debt... Similar case with you but you even are better. I hope you will enjoy very much your retirement life��. I believe my case not very rich but enough...��

Last edited:

Similar threads

- Replies

- 36

- Views

- 2K