I answered a question on Quora asking about a fixed 5% return and a 3% withdrawal.

In that scenario you will have almost half you money left after 30 years.

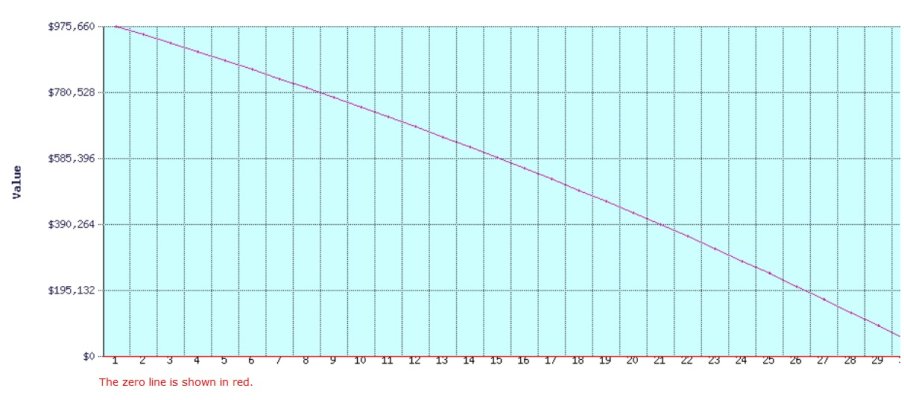

Then I pushed it and found if you invest at 5% and withdraw 4.12% your portfolio

will last just over 30 years.

I'm not recommending this, I just found it interesting and had never run FireCalc this way.

Graph shown below.

In that scenario you will have almost half you money left after 30 years.

Then I pushed it and found if you invest at 5% and withdraw 4.12% your portfolio

will last just over 30 years.

I'm not recommending this, I just found it interesting and had never run FireCalc this way.

Graph shown below.