But if the next stimulus is based on 2019 filing, then changing filing status of kid in 2020 doesn't help.

This is something we've been discussing now that our 19 year old is working full time.

The CARES Act stimulus payment was an advance on a credit that will be available on the 2020 Form 1040. For many people, they will have received the advance credit in the past few months which will equal the credit calculated based on their 2020 information.

But for some, like my son, who was my over-17 dependent in 2019 but will not be my dependent in 2020, they will get the credit when they file their 2020 return. This would also apply to people whose AGI dropped from 2019 to 2020 to where they are entitled to a credit or more of a credit than their 2019 tax return would indicate.

I expect the HEROES/LEAPS Act stimulus payments to be treated similarly but we will have to wait and see on those.

...

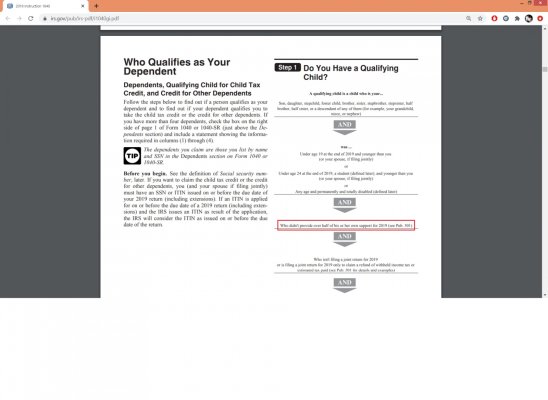

OP, there are criteria laid out quite clearly (although it can get complicated with college kids) as to whether you can claim someone as a dependent. See the instructions for the dependent line on Form 1040 at the IRS starting at page 16 at

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf.

If you claim someone but are not entitled to, that is a problem that could get caught in an audit.

If you are entitled to claim someone and do, that's pretty normal.

If you are entitled to claim someone, you are not required to do so. However:

1. This will usually result in increased taxes for you if you do not.

2. I believe most IRS rules are written as "If you can be claimed by someone else as a dependent, then...." So if you are not claiming them as a dependent in order for them to qualify for some tax benefit, they still would typically not qualify because it is whether you *can* claim them, not whether you *do* claim them. This would, for example, apply to the CARES Act $1,200 credit - if your child was your dependent but you did not claim them, they still would not be entitled to the credit.

So what you should do is read through the rules and see if you can claim them or not. If you can claim them, I really can't think of any typical situation where it would be to your benefit not to claim them. If you wanted to figure the taxes both ways and then decide, you could certainly do that, but again, note that not claiming them when they are claimable usually will not make things better for their tax return.