DayDreaming

Full time employment: Posting here.

- Joined

- Jan 19, 2008

- Messages

- 850

I know there heave been discussions here on whether or not 'international' funds are needed in one's investment portfolio. Looking back a bit historically, I don't see where international funds ever really helped, so I'm wondering - was there ever a time period where international really did well?

For example, my own investments are pretty close to the classic Boggleheads 3-fund portfolio:

I did a comparison of:

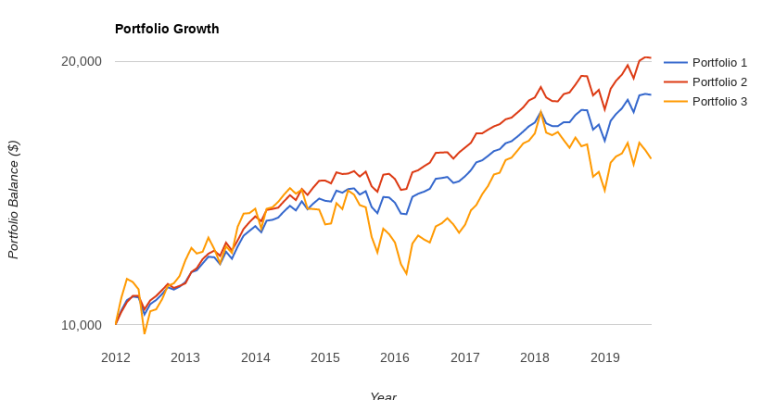

Portfolio 1: VTSAX 42%, VFWAX 18%, VBTLX 40%

Portfolio 2: VTSAX 60%, VBTLX 40%

and just for kicks:

Portfolio 3: VFWAX 100%

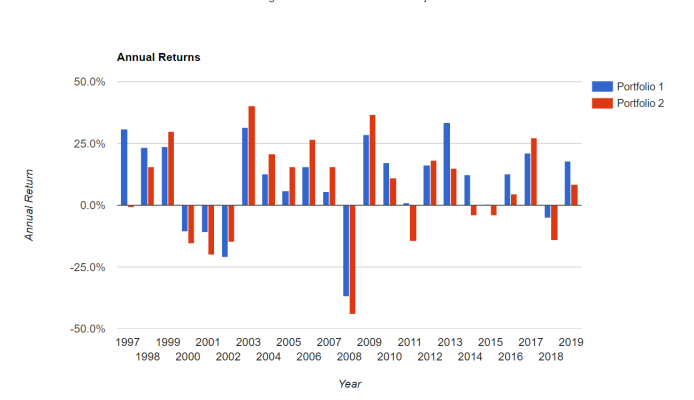

VFWAX 'international' just seems to be a drag on investment performance. In the chart below, I see that it does perform well at times, but never enough to really beat out VTSAX. Unfortunately the chart only goes back to Oct 2011 because of VFWAX.

I'm thinking about moving some (or all?) of my VFWAX to VTSAX, and maybe moving to a 2-fund portfolio, but am wondering if someone can show me a time when VFWAX (or something similar) really made sense.

link to Portfolio Visualizer

For example, my own investments are pretty close to the classic Boggleheads 3-fund portfolio:

- VTSAX - Total Stock

- VFWAX - All-World ex-US

- VBTLX - Total Bond

I did a comparison of:

Portfolio 1: VTSAX 42%, VFWAX 18%, VBTLX 40%

Portfolio 2: VTSAX 60%, VBTLX 40%

and just for kicks:

Portfolio 3: VFWAX 100%

VFWAX 'international' just seems to be a drag on investment performance. In the chart below, I see that it does perform well at times, but never enough to really beat out VTSAX. Unfortunately the chart only goes back to Oct 2011 because of VFWAX.

I'm thinking about moving some (or all?) of my VFWAX to VTSAX, and maybe moving to a 2-fund portfolio, but am wondering if someone can show me a time when VFWAX (or something similar) really made sense.

link to Portfolio Visualizer

or have you come up with strategy?

or have you come up with strategy?