CRLLS

Thinks s/he gets paid by the post

I'm not talking about premium increases in this thread. We are covered to the current value of the home. Most insurer's recommend insuring for replacement costs not market value. I think my policy has a replacement cost section mentioned, at some % over the insured value. I'll have to review it to check. It has been a few years since I really read my policy in detail.

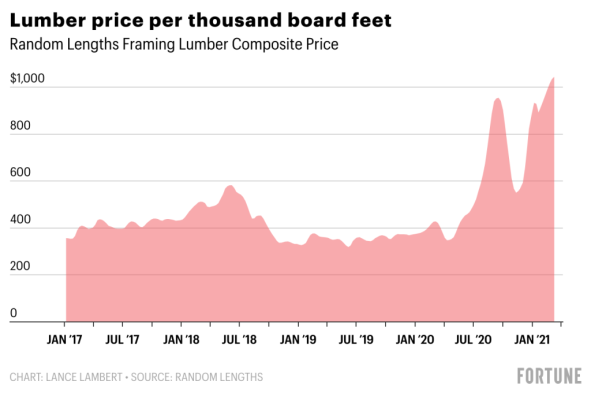

Considering the recent enormous increases in building material costs, I am beginning to wonder if my homeowner's coverage is enough. Has anybody raised their coverage due to the rebuild costs (not fair market value)?

Considering the recent enormous increases in building material costs, I am beginning to wonder if my homeowner's coverage is enough. Has anybody raised their coverage due to the rebuild costs (not fair market value)?