- Joined

- Nov 27, 2014

- Messages

- 9,251

Was reading this article:

https://www.barrons.com/articles/re...vesting-savings-51673038954?mod=Searchresults

Note - It looks like the article is behind a paywall, but I just closed the subscribe window and it let me read it.

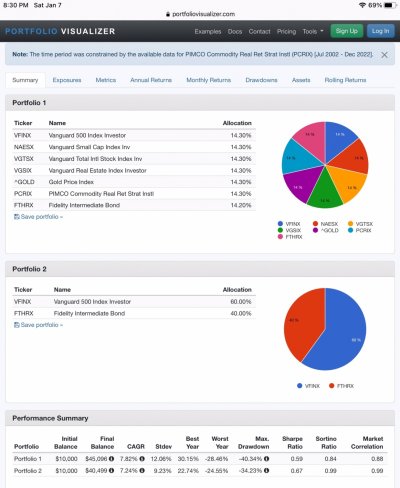

And wondered what y’all think. It’s a lot like the “perfect” portfolio but has seven components rather than 4.

From the article:

https://www.barrons.com/articles/re...vesting-savings-51673038954?mod=Searchresults

Note - It looks like the article is behind a paywall, but I just closed the subscribe window and it let me read it.

And wondered what y’all think. It’s a lot like the “perfect” portfolio but has seven components rather than 4.

From the article:

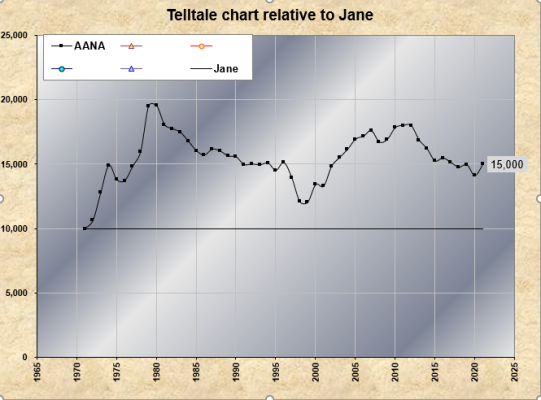

It consists simply of splitting your investment portfolio into 7 equal amounts, and investing one apiece in U.S. large-company stocks (the S&P 500SPX +2.28% ), U.S. small-company stocks (the Russell 2000RUT +2.26% ), developed international stocks (the Europe, Australasia and Far East or EAFE index990300 +1.75% ), gold, commodities, U.S. real-estate investment trusts or REITS, and 10 year Treasury bonds.

It’s beaten the standard Wall Street portfolio of 60% U.S. stocks and 40% bonds. Not just last year, when it beat them by an astonishing 7 percentage points, but for half a century.