Rothman

Recycles dryer sheets

- Joined

- Apr 30, 2013

- Messages

- 252

I struggle with this. I've read reducing equity exposure at retirement, even without using a rising glide path, helps to reduce sequence of returns impact. Were you at all concerned with SOR, and if not, why not? Also, can you explain your reasoning behind feeling 60/40 isn't too conservative for someone in retirement? I ask because I'm at 40/60 having just retired and whether I raise that ratio will depend a lot on what the PF looks like in say, 5 or 10 years.

Just interested in your thinking in order to perhaps educate mine.

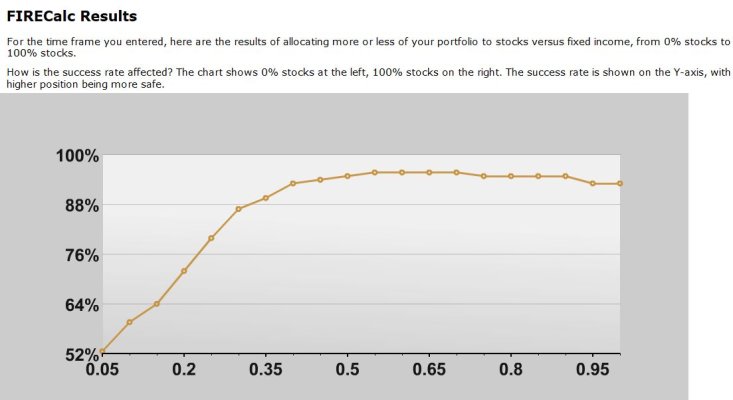

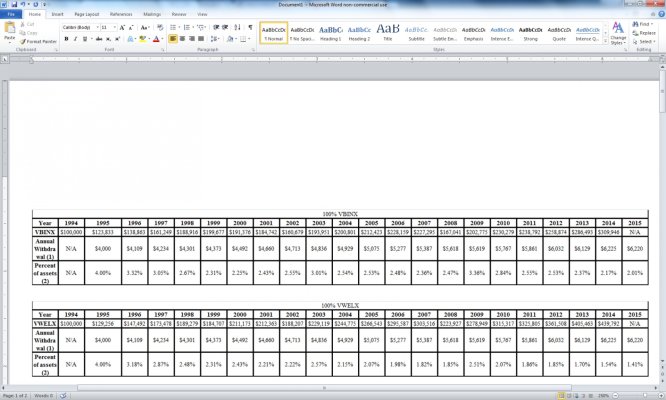

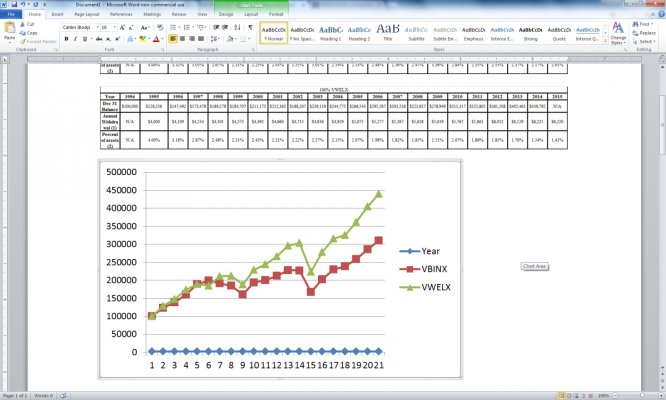

Well if you base the decision on firecalc scenarios the answer is higher equity AA, something more like 75% equity does better. You have two different enemies, inflation that equities fight and loss of principal that bonds avoid. Why many go to more bonds in AA is they conclude they have already won the game, either due to size of portfolio or inflation adjusted pensions and don't see reason for the additional equity risk. So to your question do you have inflation adjusted pension or SS, or a small SWR need, then your decision seems fine.

Sent from my iPad using Early Retirement Forum