pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Heh, heh, just wait until that happens to our gummint. (Biggest budget item could soon be servicing our massive debt.)

Well, if facts just happen to make any difference for ya:

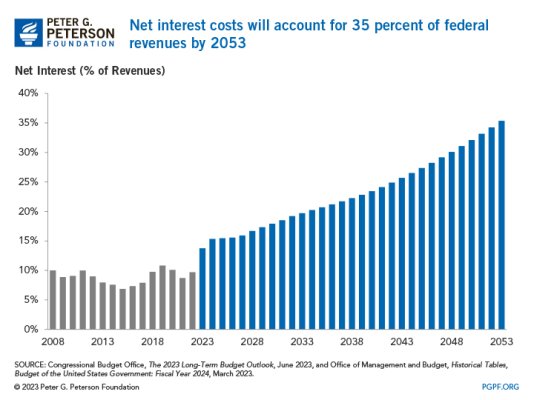

In fiscal year 2023, the United States government is projected to spend $726 billion on interest payments on the national debt. This is about 14% of the total federal budget of $5.2 trillion.

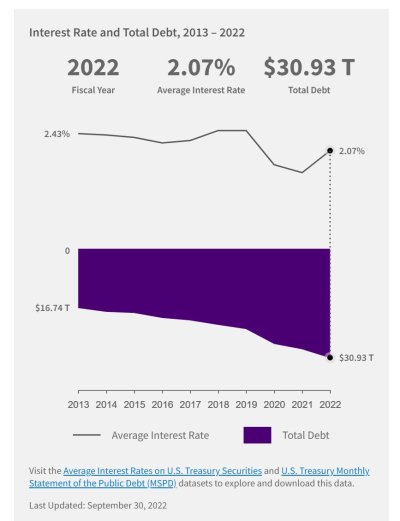

The interest rate on the national debt is currently about 2.07%. This is relatively low compared to historical levels, but it is still higher than the rate of inflation. As a result, the government is paying more to borrow money than it is actually getting back in terms of purchasing power.

The Congressional Budget Office (CBO) projects that interest payments on the national debt will continue to grow in the coming years. By 2033, they are projected to reach $1.1 trillion, or 18% of the total federal budget. ...