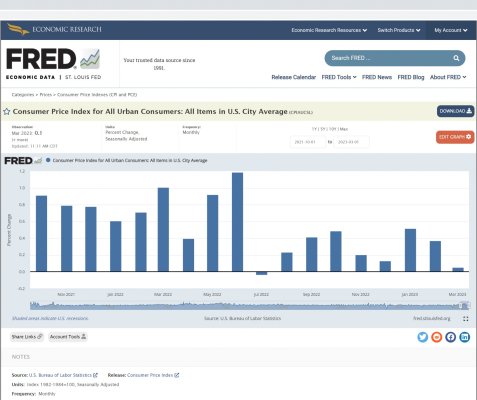

Average apartment is up around $250 from $1100 in two years year. That is 22% CPI has it at 11% over the last 2 years since they determine it by asking Aunt Louise how much she thinks her house would rent for, not actual rents.

Rents in my town have gone from $950 for a two bedroom in 2021 to $1500 today. If you are a renter and living on a 18-25 per hour job inflation is really affecting you. If

you are a millionaire retired with a bunch of CD's and a paid off house or one with a 3% mortgage, you like FED President Mary Daly, think everyone complaining about inflation should just relax and that many many Americans have enough money to not worry about inflation. For the poor that she saw as effected she said:

"You may not be able to go to the vacation you want. You may end up instead camping or doing a stay-cation," Daly said. "Or what you used to eat out to do, you eat in your hotel because you can't really afford getting there and then going out to dinner once you're at the hotel. And I see all of that."

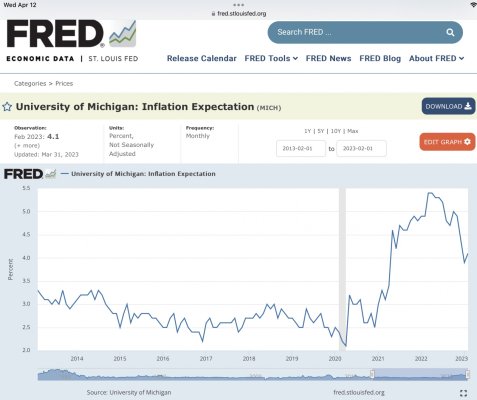

This is a bad take and inflation with a 2 Trillion dollar deficit running, is going to be interesting. The idea you could spend 2 trillion without any productive work backing it and counting on people holding treasuries to offset the increase in currency is a roulette game in the long run. The idea that 5 percent inflation is controlling inflation when the numbers are massaged to present the best possible case is worrisome.