I just received a notice it was increasing 69.49% or to $612 per quarter ($2448 annual). The options offered are: Keep coverage intact and pay the increased premium, keep the same premium, but lower inflation rider from 5% to 3.2% or “call to discuss lowering the daily benefit, elimination period or benefit period.” Due to the 5% inflation rider, my daily benefit is now $217 or about the cost of nursing homes in my area (middle Tennessee). I really don’t want to reduce the benefit period, but did call JH to get a premium based on 5 years benefits. The price was $1852 annual vs the increased premium of $2400 or the reduced 3.2% inflation offer and keep my current premium intact at $1444 annual.

I assume there will be future increases or trade-off offers. My agent says the lower inflation rider offer is a one-time “landing place” that won’t be offered again. I don’t think 3.2% will keep up with cost of facilities, but sure beats nothing and keeps my premium the same. I could afford to pay the increased premium now, but am apprehensive I might not with future increases/tradoffs and be forced to cut my benefits or even drop it if the premium got too high. Anyone's thoughts are appreciated.

I'm no expert by any means, but do have LTC ins. and have had significant premium increases. Here are my thoughts:

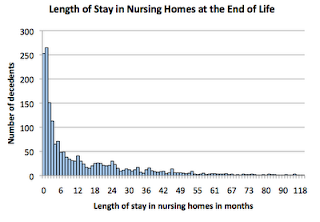

My memory is hazy, but I believe I was told MOST people do not need benefits for longer than 3 years. First reason is that people either get better (they are in a nursing facility because they can not convalesce at home - e.g., stroke - before 3 years they recover enough to go home.) or they die from what put them in the nursing home. Obviously, there is an actuarial element to this. Some folks linger for 20 years and others are in and out within a few weeks. BUT, the bulk use the benefit for 3 or fewer years (IIRC). Check this out yourself!!

Regarding further premium increases. Supposedly, the increases were due to the insurance company miscalculating how many people would lapse their policies (without ever using the benefit). Hopefully, they now have that right. Any other reason to raise a premium SHOULD be cooked in the broth, actuarially. THESE kinds of things, the insurance companies should KNOW to the 3rd decimal point already. SO, in (my) theory, the major increases should be behind us. (Here's hoping.) Maybe your rep will share her thoughts on this - sometimes the true info leaks to the reps.

The LAST thing I would sacrifice would be the inflation rider. Even 5% is not currently keeping up with LTC inflation. If you can, look at the costs of the LTC facility you are familiar with and see if they have increased their rates at 5% or MORE in the last several years. You might have to play dumb with them to get this info (just planning for LTC insurance, you see - which is true.)

Finally, the big question is whether you have the assets to go naked or whether it makes sense to have LTC insurance. One strategy might be to drop your coverage to 2 years (or even one if they will allow it). This will GET YOU IN THE DOOR of the LTC facility. Once you are there for some period of time, I believe they are required (or at least usually DO) keep you and accept Medicade coverage.

Next to plain old medical insurance, LTC is the wild card that plagues all but the "rich" when it comes to ER (my opinion, of course). WE NEED TO GET THIS RIGHT PERHAPS MORE THAN WHEN TO TAKE SS. Lots of strategies (go naked, limited coverage, full coverage, set aside cash, have an annuity, the 9mm solution, etc. etc.) No one answer.

Keep in mind, you are getting this from a dummy who cares, but isn't an expert. Use lots of grains of salt and DO LOTS OF RESEARCH! Very best of luck.