Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Has anybody had experience with buying LTC insurance with a long waiting period - say 12-18 months?

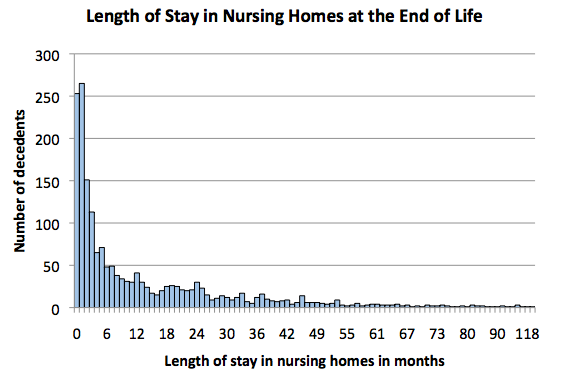

Many of us can afford to fund 6 months or even a year of LTC, but if care is needed for many years or the rest of our lives, that can be an asset destroyer. I am thinking that a LTC policy that would kick int after about 12 months of care over a certain period of time (say 12 months in about 5 years, not necessarily sequential).

Ideally, there would also be a cap on the premiums such as I had with life insurance years ago - it came with a table showing the lowest, expected, and highest premiums.

My fear is that often people are priced out of the market just as they get to the point in their lives when the odds of collecting on the policy are the highest.

Note: Hopefully, I will never have to collect on an LTC policy.

Many of us can afford to fund 6 months or even a year of LTC, but if care is needed for many years or the rest of our lives, that can be an asset destroyer. I am thinking that a LTC policy that would kick int after about 12 months of care over a certain period of time (say 12 months in about 5 years, not necessarily sequential).

Ideally, there would also be a cap on the premiums such as I had with life insurance years ago - it came with a table showing the lowest, expected, and highest premiums.

My fear is that often people are priced out of the market just as they get to the point in their lives when the odds of collecting on the policy are the highest.

Note: Hopefully, I will never have to collect on an LTC policy.