You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Making a quarterly tax payment using EFTPS

- Thread starter Time2

- Start date

Bryan Barnfellow

Thinks s/he gets paid by the post

Are you making a business payment? If not, try using the online form at this link. I have used it for quarterly payments and it has worked flawlessly for more than a decade or so. It deducts from your US checking account. You set the amount, the type of payment (e.g., estimate payment for 2023), and the date it should be taken out of your bank account.

https://directpay.irs.gov/directpay/payment?execution=e2s1

-BB

https://directpay.irs.gov/directpay/payment?execution=e2s1

-BB

That kind of defeats the whole sign up for EFTPS. But if I don't get answer before I need to pay it, I'll use that. Thanks.Are you making a business payment? If not, try using the online form at this link. I have used it for quarterly payments and it has worked flawlessly for more than a decade or so. It deducts from your US checking account. You set the amount, the type of payment (e.g., estimate payment for 2023), and the date it should be taken out of your bank account.

https://directpay.irs.gov/directpay/payment?execution=e2s1

-BB

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

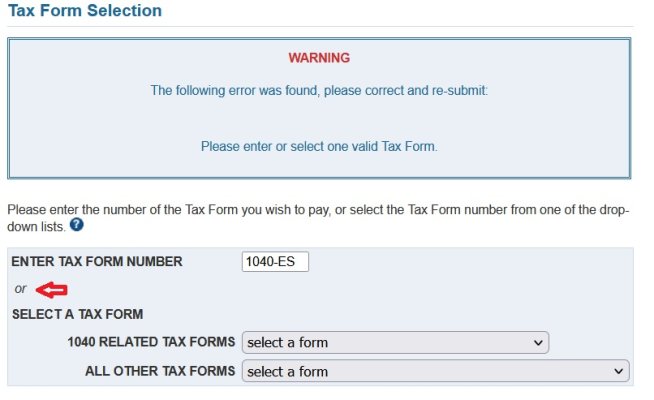

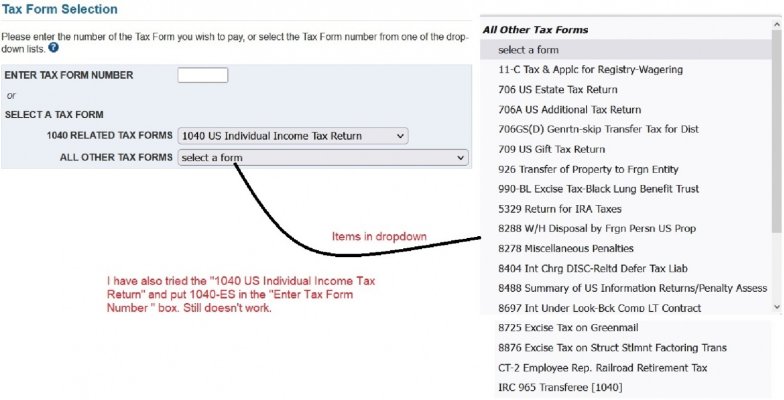

Isn’t 1040-ES in the 1040 Related Tax Forms drop down list?

Attachments

fosterscik

Full time employment: Posting here.

You select 1040 us individual tax form, then NEXT (nothing from the other dropdown).

On the next page ESTIMATED 1040ES is presented as the first radio button choice and you should be on your way!

I've used it for a couple of years to schedule my year's prepayments and especially like the email a few days ahead of each withdrawal to make sure I have the funds in my bank account

On the next page ESTIMATED 1040ES is presented as the first radio button choice and you should be on your way!

I've used it for a couple of years to schedule my year's prepayments and especially like the email a few days ahead of each withdrawal to make sure I have the funds in my bank account

Nope,

Just did this recently & I think you go one screen past what you posted & then select -es. I'm being lazy & not logging in myself, but hope you'll let us know if it works

You select 1040 us individual tax form, then NEXT (nothing from the other dropdown).

On the next page ESTIMATED 1040ES is presented as the first radio button choice and you should be on your way!

I've used it for a couple of years to schedule my year's prepayments and especially like the email a few days ahead of each withdrawal to make sure I have the funds in my bank account

Thank you! I have my conformation that I paid. I also now have a note on my "income tax file folder" on what buttons to push and not push to make this flow smoothly.

gauss

Thinks s/he gets paid by the post

- Joined

- Aug 17, 2011

- Messages

- 3,615

Don't forget to ensure that the 1040 / 1040-ES payment is assigned to the proper/intended tax year.

In the IRS world, I believe that every tax year is treated as an independent account.

-gauss

In the IRS world, I believe that every tax year is treated as an independent account.

-gauss

Don't forget to ensure that the 1040 / 1040-ES payment is assigned to the proper/intended tax year.

In the IRS world, I believe that every tax year is treated as an independent account.

-gauss

Yep, estimates taxes for 2023.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Don't forget to ensure that the 1040 / 1040-ES payment is assigned to the proper/intended tax year.

In the IRS world, I believe that every tax year is treated as an independent account.

-gauss

The tricky one is the final estimated tax payment paid in Jan of the following year. You have to be sure to put in the previous year. I made this mistake once long ago but realized it later and was able to call in and get it fixed (although they told me the EFTPS history wouldn’t change). This was back when you could get a human on the phone. I always double check now.

mpeirce

Thinks s/he gets paid by the post

I guess you can use either for estimated taxes.

I personally use IRS Direct Pay. Easy to use and it worked great for me yesterday.

The difference between Direct Pay and EFTPS

The difference between EFTPS and the IRS’s other electronic payment tool, Direct Pay, is quite simple. Both individuals and business owners may pay federal taxes using EFTPS, whereas Direct Pay is only available to individuals. In addition, there is no limit to the amount of money that can be sent via EFTPS, unlike Direct Pay, which caps at $10 million.

So I guess when my taxes hit $10,000,000 I’ll switch

I personally use IRS Direct Pay. Easy to use and it worked great for me yesterday.

The difference between Direct Pay and EFTPS

The difference between EFTPS and the IRS’s other electronic payment tool, Direct Pay, is quite simple. Both individuals and business owners may pay federal taxes using EFTPS, whereas Direct Pay is only available to individuals. In addition, there is no limit to the amount of money that can be sent via EFTPS, unlike Direct Pay, which caps at $10 million.

So I guess when my taxes hit $10,000,000 I’ll switch

rk911

Thinks s/he gets paid by the post

- Login

- Click PAYMENTS at the top of the screen

- In SELECT A TAX FORM click 1040 US INDIVIDUAL INCOME TAX RETURN

- Click NEXT

- Click ESTIMATED 1040ES

- Click NEXT

- Click PAYMENTS at the top of the screen

- In SELECT A TAX FORM click 1040 US INDIVIDUAL INCOME TAX RETURN

- Click NEXT

- Click ESTIMATED 1040ES

- Click NEXT