Ugh! Too late!

Should have waited on your response.

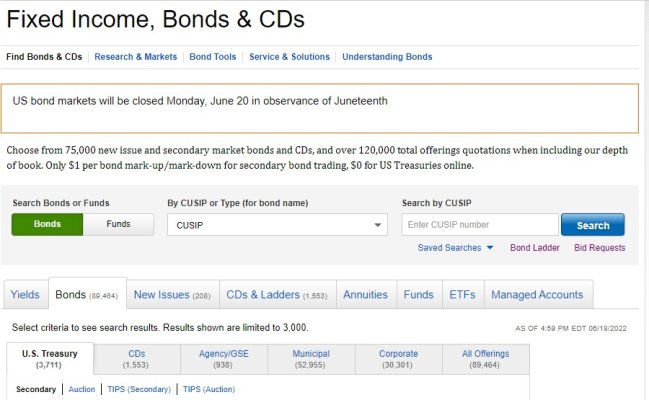

I was not aware of the impact of mandatory sinking fund redemption. It is listed on the TDA Advanced search. I have modified my selection criteria to exclude "Sinking Fund". See list below (not sure how to paste a screenshot). Should I "Exclude" all of the listed constraints?

The reality is that I have been sitting on way too much cash in my t-IRA for a long time. If it gets called next July then at least I will earn > 0$.

I am willing to learn. Have plenty of time on my hands. I hope that I can use Muni Bonds to generate yield during these rough times.

*************************Include Exclude None

General Obligation

Build America Bonds (BABs)

Green Bonds

Escrowed To Maturity

Sinking Fund

Extraordinary Redemption

Insured

Revenue

Taxable

Bank Qualified

Callable

Subject To AMT

Putable

Pre-Refunded

Zero Coupon

I'm a little gunshy now. What search can I use that will allow me to prevent stepping on a land mine?