vttlarry

Recycles dryer sheets

I mentioned in an earlier post that I am looking at rolling over a 401k and cash balance plan to an IRA.

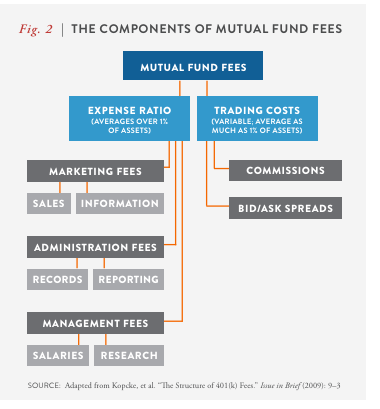

Can someone address the issue of mutual fund fees? Recent articles have addressed how other costs, such as brokerage commissions, bid/ask spreads and opportunity and market impact costs can all add to the expenses that are NOT including in the expense ratio.

Even with lower fees from Vanguard, they are still .31 for one fund I was looking at. With 200K invested, plus other fees, that can start to add up. I had been looking at purchasing a bundle of blue chip, dividend paying stocks (15). At $7 a trade, it starts to look at lot cheaper than all the fees.

Anyway, comments and suggestions , please. Thanks.

Can someone address the issue of mutual fund fees? Recent articles have addressed how other costs, such as brokerage commissions, bid/ask spreads and opportunity and market impact costs can all add to the expenses that are NOT including in the expense ratio.

Even with lower fees from Vanguard, they are still .31 for one fund I was looking at. With 200K invested, plus other fees, that can start to add up. I had been looking at purchasing a bundle of blue chip, dividend paying stocks (15). At $7 a trade, it starts to look at lot cheaper than all the fees.

Anyway, comments and suggestions , please. Thanks.