RonBoyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

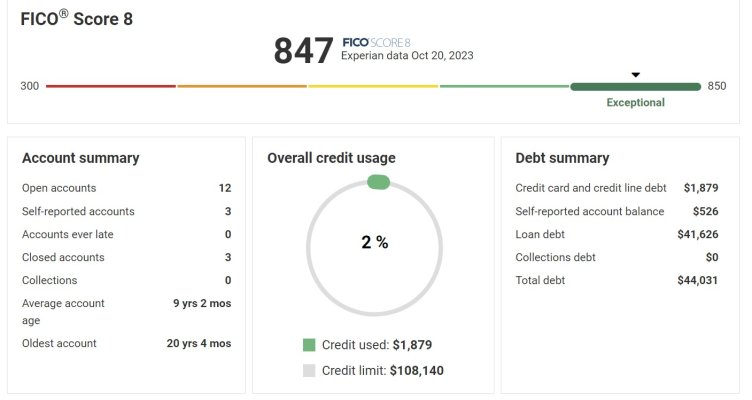

For those that are worried about getting credit after retirement.

This was sort of a surprise to me:

I have not had a steady source of income for over twenty-five years... except SS. We run all expenditures through seven credit cards --about $4,000 a month (paid monthly).

The $41,000 debt is a zero-interest loan from Chrysler. I did this because the lack of Interest was roughly what investing would have gotten me... and that it might keep my credit rating alive.

Anyway, I now wonder what I have to do to get the other three points for a perfect score. <chuckle>

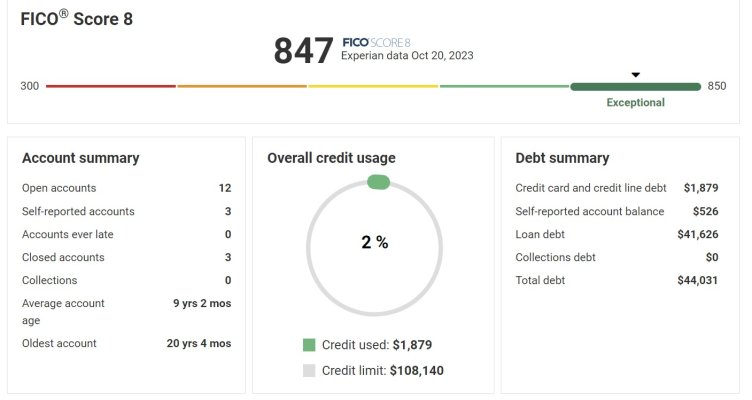

This was sort of a surprise to me:

I have not had a steady source of income for over twenty-five years... except SS. We run all expenditures through seven credit cards --about $4,000 a month (paid monthly).

The $41,000 debt is a zero-interest loan from Chrysler. I did this because the lack of Interest was roughly what investing would have gotten me... and that it might keep my credit rating alive.

Anyway, I now wonder what I have to do to get the other three points for a perfect score. <chuckle>