FireDreamer

Dryer sheet wannabe

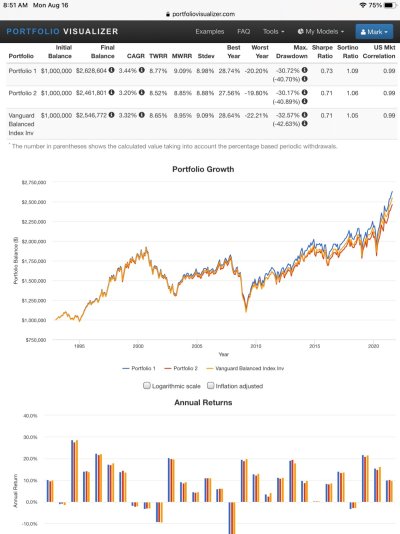

As we get closer to our 'number', I'm exploring ways to manage our nest egg in FIRE. I have two questions. First, how to organize our accounts to minimize the sequence of returns risk? I'm thinking of building up a large reserve of cash (1-3 years of expenses) to buffer against extended down markets as this seems to the approach most folks take. To choose the source of our 'salary' per (year? Quarter? Month?), sell from the best performing asset class; if all are down, pull from the cash reserve to fund our 'salary'. At the end of each year, rebalance. I'm not clear on the trigger to replenish the cash reserves, however. Or, do you simply consider the cash reserves as the 'bond' AA, and let rebalancing refill?

The second part I'm not settled on is - how to manage after-tax and tax-deferred accounts since I won't be able to touch the tax-deferred accounts for close to 10 years (FIRE before 50 based on current trajectory). Do I treat them as two separate AA, or as one big pile of money as I have been? The risk of two separate is I'll have a larger investment in bonds in my after tax accounts than I would like. However, the risk of one big pile of money is I won't be able to rebalance as easily as I withdraw down from my after-tax funds. Seem like two different piles with their own AA.

How did others approach these?

The second part I'm not settled on is - how to manage after-tax and tax-deferred accounts since I won't be able to touch the tax-deferred accounts for close to 10 years (FIRE before 50 based on current trajectory). Do I treat them as two separate AA, or as one big pile of money as I have been? The risk of two separate is I'll have a larger investment in bonds in my after tax accounts than I would like. However, the risk of one big pile of money is I won't be able to rebalance as easily as I withdraw down from my after-tax funds. Seem like two different piles with their own AA.

How did others approach these?