Markola

Thinks s/he gets paid by the post

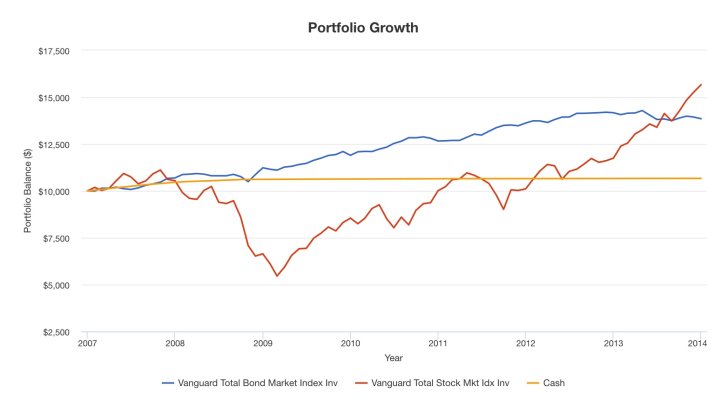

I'm a bit uneasy about the possibility of a market crash while FIRE and taking money out of the market in that time. Perhaps its not as bad as I think it will be because my bond/fixed income assets won't be as affected and will sustain us during those times?.

These graphs of the last two major recession periods ought to help you answer that. They do for me, anyway, and illustrate why I’ll happily remain fully invested at 50/50 stocks/bonds with $0 cash(drag) beyond the modest checking account.

Attachments

Last edited: