corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

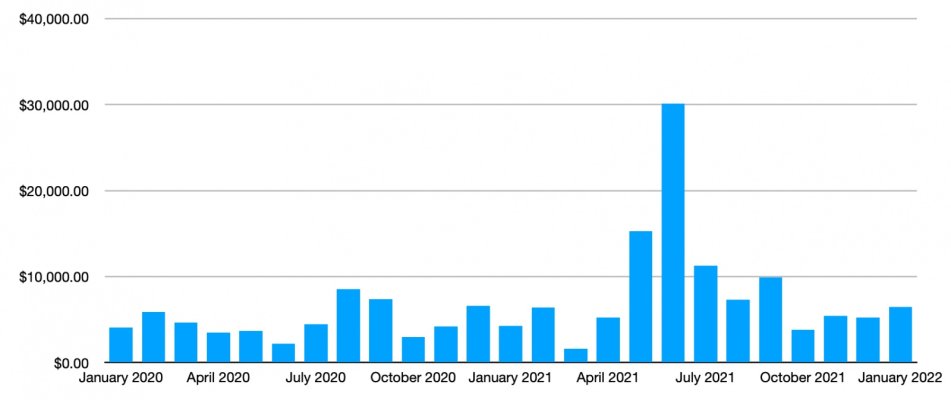

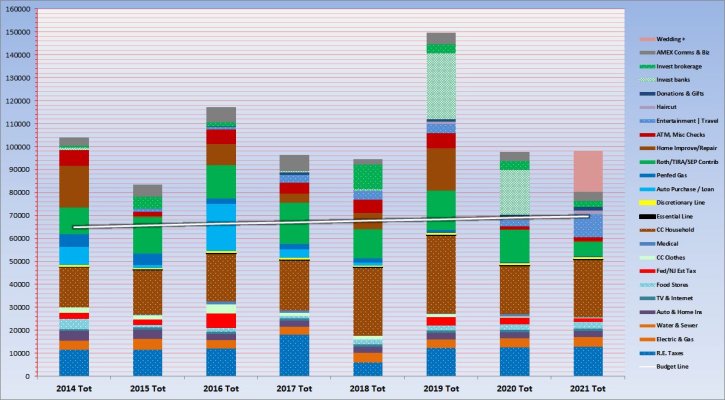

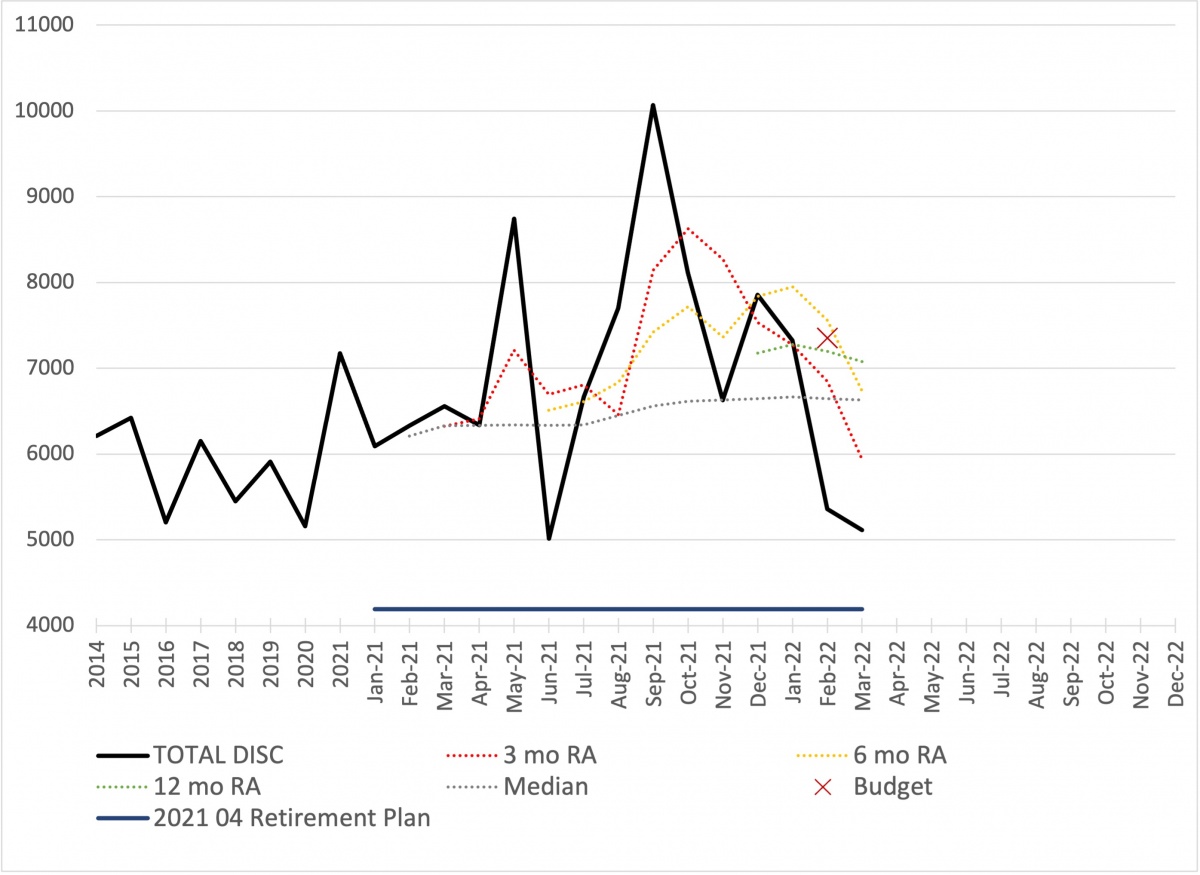

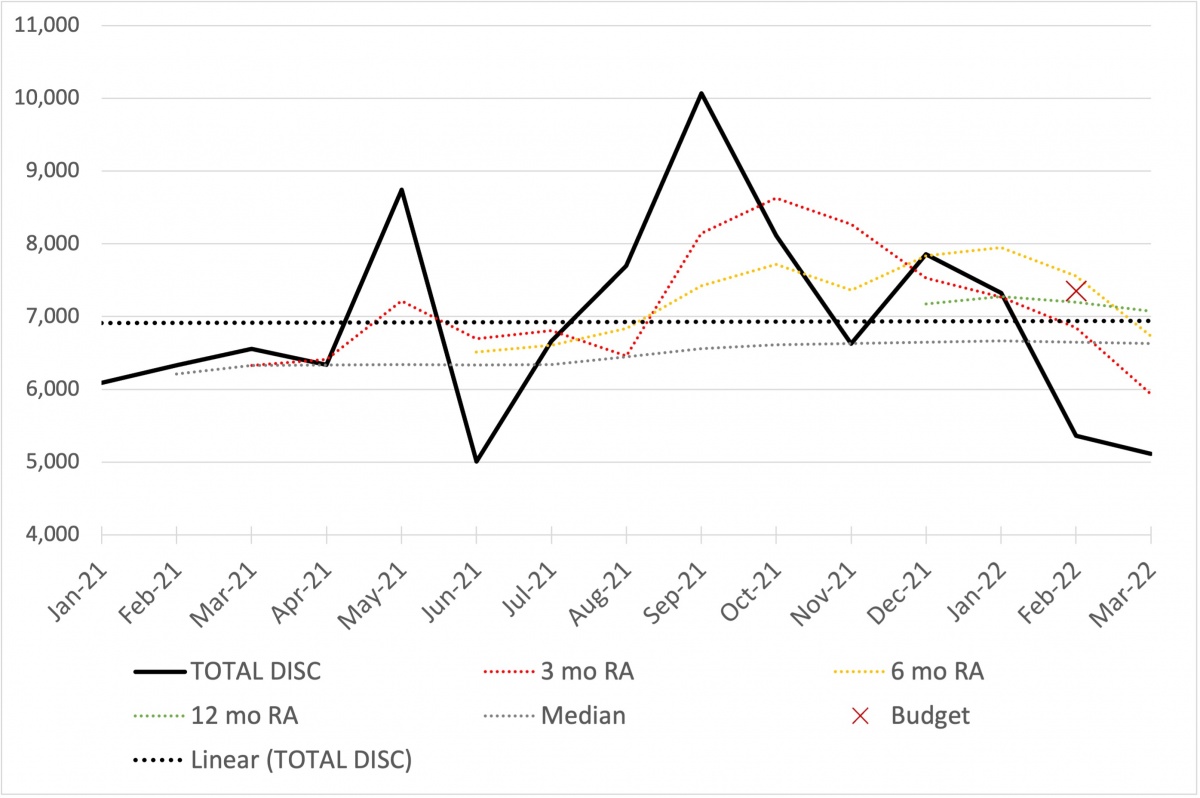

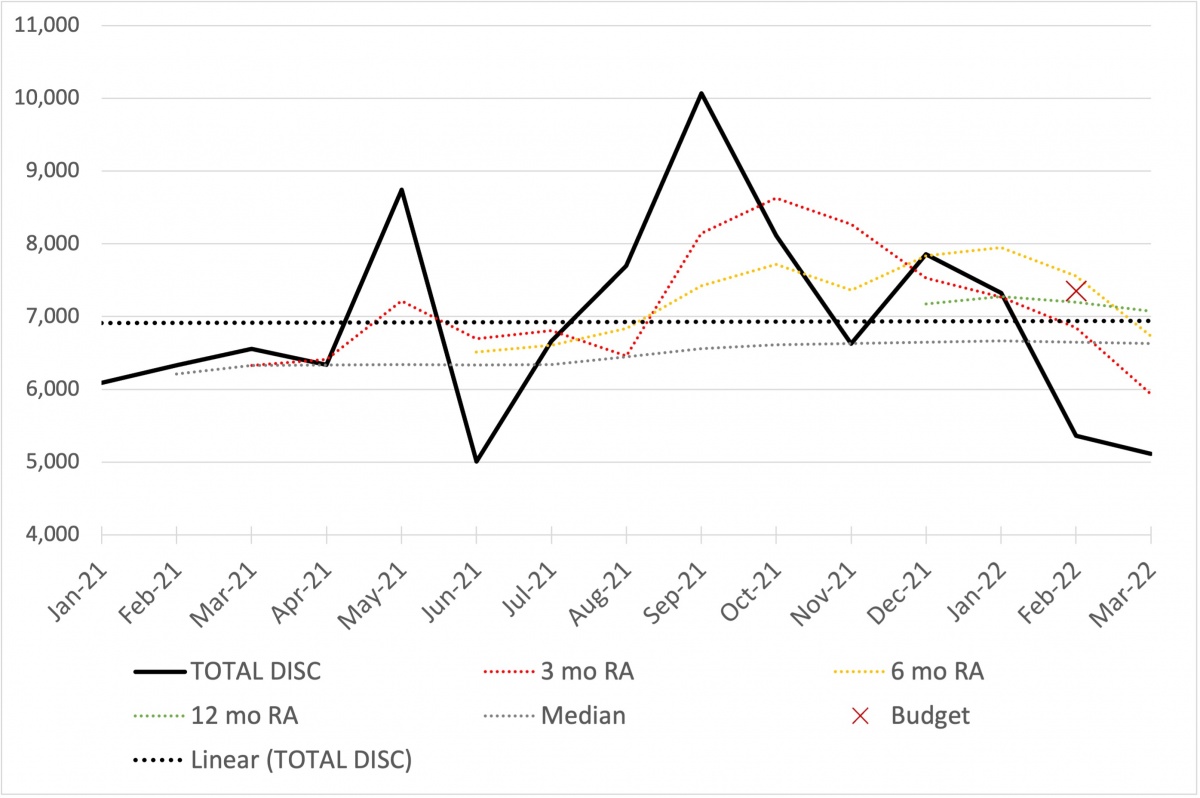

Retired last year @ 55. We didn't follow a budget this past year, just spent what we wanted. Now that I have a year's worth of data, I am trying to figure out what to do with it for planning the next 40 years. I had a number I used to decide to retire, but it was all wrong.

The only noisy data is what I categorize as our discretionary spending. It's the wrong label for what it includes, but it's what I have used for 20 years. Here's what's in the noisy data:

Auto

Fuel

Clothes

Pets

Food

Dining

Gifts

Health / Beauty

House

Entertainment

Misc

The nosiest is Auto (new tires, maint), pets (ER visits, got a puppy) and house (bought a new house last year and now filling it up with stuff).

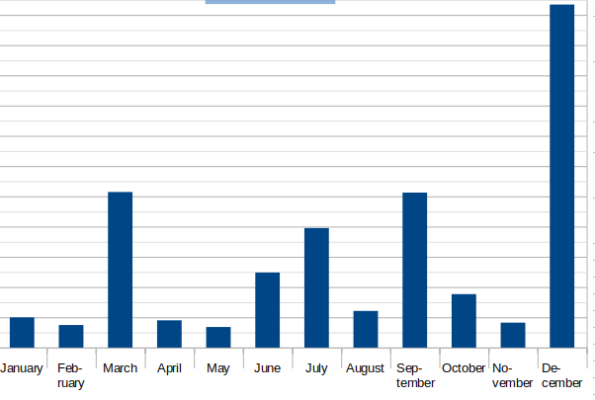

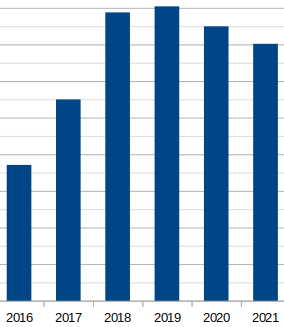

Here's what the data show:

For future planning, I am using the red X on the right. Seems like as good a guess as any.

What do you think?

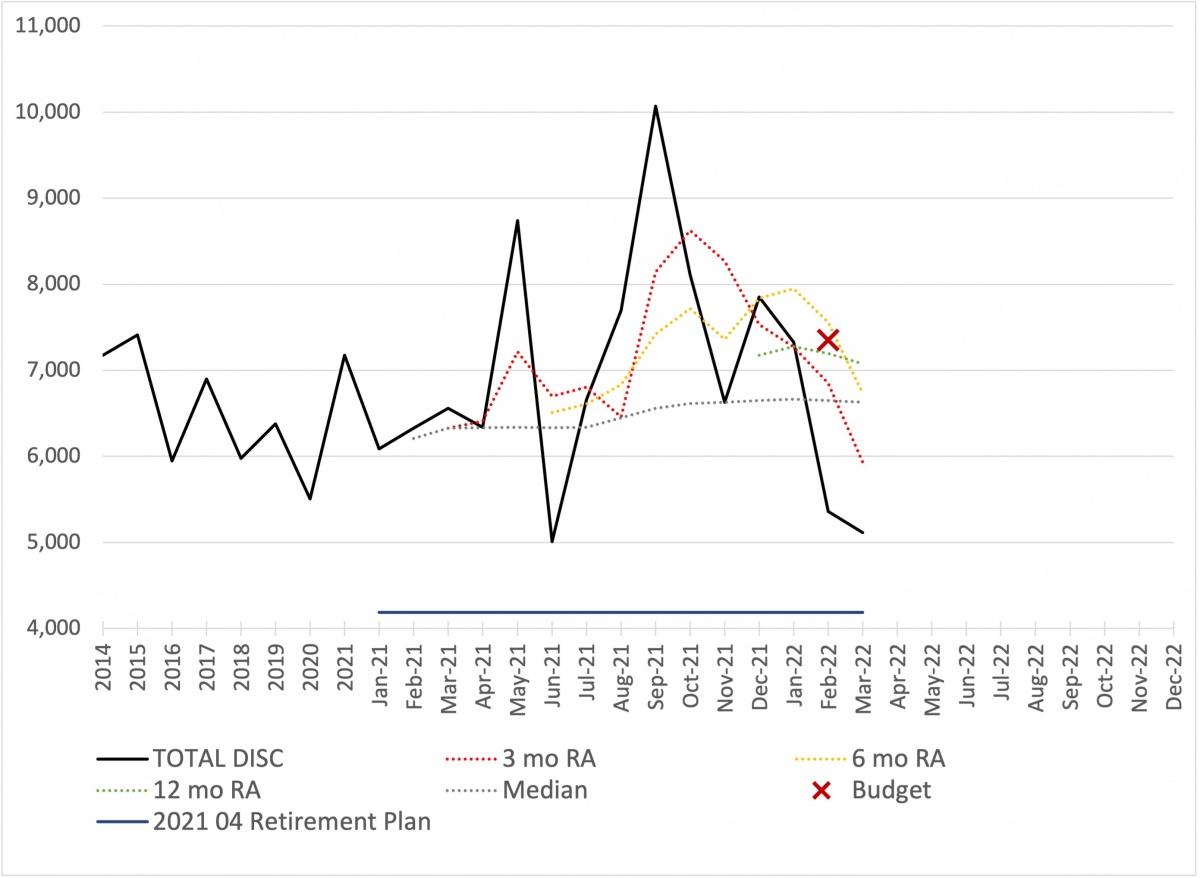

The only noisy data is what I categorize as our discretionary spending. It's the wrong label for what it includes, but it's what I have used for 20 years. Here's what's in the noisy data:

Auto

Fuel

Clothes

Pets

Food

Dining

Gifts

Health / Beauty

House

Entertainment

Misc

The nosiest is Auto (new tires, maint), pets (ER visits, got a puppy) and house (bought a new house last year and now filling it up with stuff).

Here's what the data show:

For future planning, I am using the red X on the right. Seems like as good a guess as any.

What do you think?

Last edited: