Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

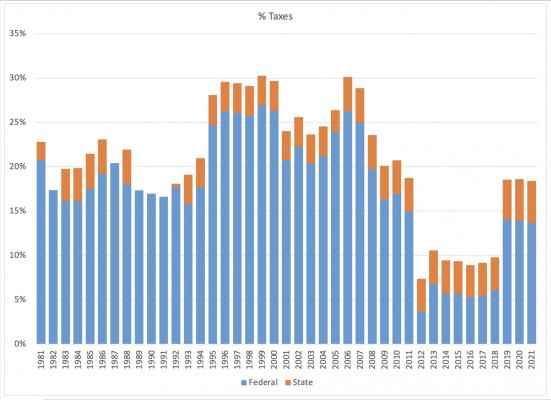

I've gotten used to it, but voluntarily paying lots of extra taxes for Roth conversions since 2019 has been hard to stomach. But I know it's the right thing to do.

Looking back at our effective tax rates makes it clear I have nothing to whine about...

I also distinctly remember doing my first tax return as a retiree in 2012 and thinking - this can't be right! But it was right.

We made less than $40K in 1982, Federal taxes were WAY more confiscatory then! Looks outrageous to me today.

Thought others might have similar records or recollections - I'd forgotten.

Looking back at our effective tax rates makes it clear I have nothing to whine about...

I also distinctly remember doing my first tax return as a retiree in 2012 and thinking - this can't be right! But it was right.

We made less than $40K in 1982, Federal taxes were WAY more confiscatory then! Looks outrageous to me today.

Thought others might have similar records or recollections - I'd forgotten.

Attachments

Last edited: