Standard Staples

Recycles dryer sheets

- Joined

- Sep 3, 2014

- Messages

- 104

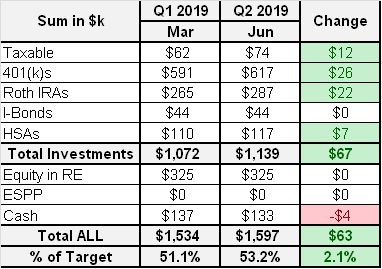

Excellent job in Q1, Exit. One red blip on your chart and right back to green. I'm sure your wife will land a new contract soon. Good luck in Q2.

I didn't realize you were turning 50 this year. Any plans for a milestone celebration/vacation?

I didn't realize you were turning 50 this year. Any plans for a milestone celebration/vacation?

Last edited: