robertf57

Recycles dryer sheets

- Joined

- Jun 8, 2014

- Messages

- 337

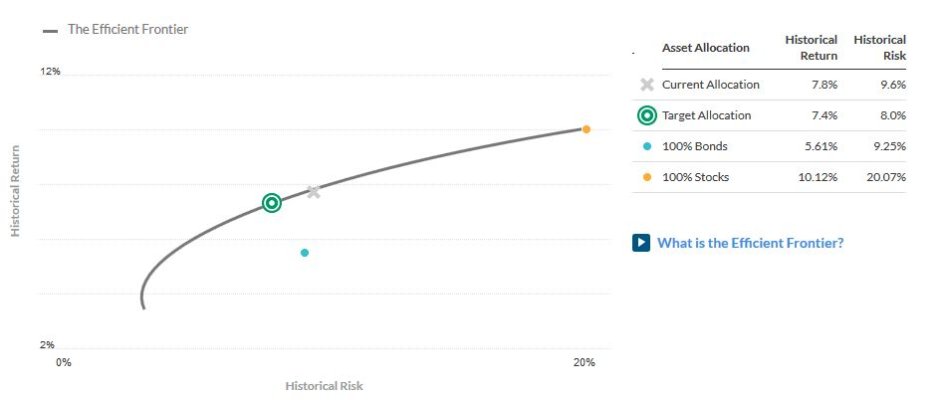

CObra and I had the same experiences. I do get an occasional email telling me my portfolio is up 0.6% this week and notices when I log on that I may have too much in cash, etc. But, no high pressure sales. I like the tool; but, it doesn't handle my defined benefit plan properly.