Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In many threads over the years on projecting spending in retirement, we see some folks who neglect those large but infrequent expenses that we cannot avoid entirely - and inevitably someone points that out. Threads that show projected spending that only include the typical frequent expenses for home maintenance, cars, insurance, entertainment, taxes, food, utilities, medical, charity, gifts, incidentals, etc. There are also large expenses most of us can't avoid but only occur every 3 to 20 years. It's hard to imagine anyone could avoid all of them for 20-30 years in retirement. Some examples like:

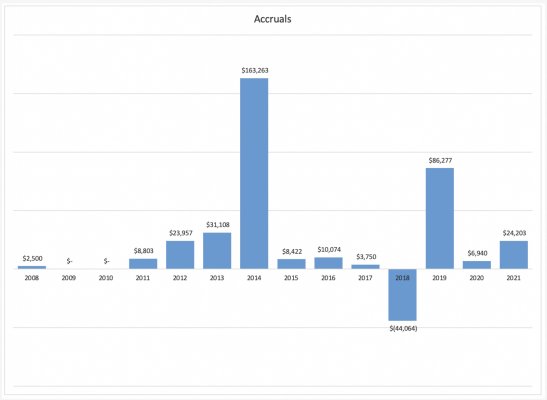

So I thought I'd show some actual history. The point is not the amounts but the irregular nature of these expenses, you can't plan the timing of some of them. [Please look past the big spikes in ours, they involved buying and selling a boat, and a relocation/new home. Though I'd imagine some of you may choose to spend on new homes, boats, etc. along the way. The other irregular expenses are not insignificant IME.]

For us these irregular expenses amount to almost 20% of our annual spending on average, but they fluctuate considerably. Your number may be higher or lower, but I am guessing it will be significant.

So my point if for those who are planning retirement spending, don't forget to allow for those large but highly irregular expenses. Being off by 20% (our example) for 20-30 years could put a serious dent in your plan...

- buying/selling boats-planes-second homes,

- replacing cars periodically,

- replacing major appliances, HVAC, furniture, consumer electronics,

- home renovations

- relocation

- replacing roofs, repainting, fence repairs,

- extraordinary travel

So I thought I'd show some actual history. The point is not the amounts but the irregular nature of these expenses, you can't plan the timing of some of them. [Please look past the big spikes in ours, they involved buying and selling a boat, and a relocation/new home. Though I'd imagine some of you may choose to spend on new homes, boats, etc. along the way. The other irregular expenses are not insignificant IME.]

For us these irregular expenses amount to almost 20% of our annual spending on average, but they fluctuate considerably. Your number may be higher or lower, but I am guessing it will be significant.

So my point if for those who are planning retirement spending, don't forget to allow for those large but highly irregular expenses. Being off by 20% (our example) for 20-30 years could put a serious dent in your plan...

Attachments

Last edited: