Retireby45ish

Recycles dryer sheets

- Joined

- Dec 8, 2018

- Messages

- 209

Was doing a bit of digging into corporate bonds today and was wondering if anyone else puts out orders to see if they’ll get filled at “good” prices.

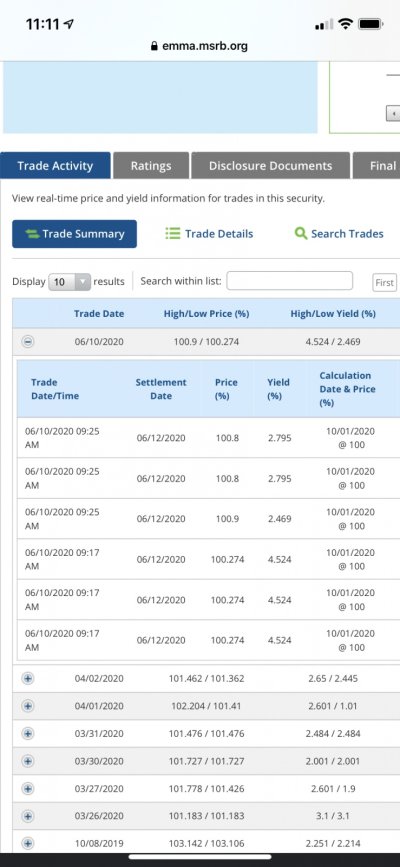

For example the bid ask spread on corporate bonds can be pretty wide. One John Deer bond was basically 100.3 at 103 which in yield terms is about 2.7% at 1.4%. Now I might want to hold this bond but I’d love 2.7% rather than 1.4% by trading vs the current best price.

You can, on fidelity, look through all the prices it has traded. And it trades plenty back and forth (every 2 or 3 days).

Does anyone go through and place an order in each day hoping to get filled at something like 2.6% and just wait until they trade? Apparently you can’t enter GTC and can only enter Day orders each morning.

Also, I was surprised that the yields on these Aa and higher bonds were around 1-2.5% when you can buy BND and get about 2.5% yield or so. But of course buying and holding these is different than the ETF which can swing.

Interesting world of bonds. Not quite sure If worth trading a bunch of individuals vs just plunking down for the ETF or Mutual fund. Thoughts?

For example the bid ask spread on corporate bonds can be pretty wide. One John Deer bond was basically 100.3 at 103 which in yield terms is about 2.7% at 1.4%. Now I might want to hold this bond but I’d love 2.7% rather than 1.4% by trading vs the current best price.

You can, on fidelity, look through all the prices it has traded. And it trades plenty back and forth (every 2 or 3 days).

Does anyone go through and place an order in each day hoping to get filled at something like 2.6% and just wait until they trade? Apparently you can’t enter GTC and can only enter Day orders each morning.

Also, I was surprised that the yields on these Aa and higher bonds were around 1-2.5% when you can buy BND and get about 2.5% yield or so. But of course buying and holding these is different than the ETF which can swing.

Interesting world of bonds. Not quite sure If worth trading a bunch of individuals vs just plunking down for the ETF or Mutual fund. Thoughts?