You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retired for more than 7 years, what % has your NW increased or decreased?

- Thread starter Time2

- Start date

Bamaman

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

When I retired in 2008, the equities had just bombed. 12 years later, I'm far ahead of where I was even prior to the market decline that year. I was fortunate to avoid drawing on the IRA Rollover account until the RMD's kick in 14 years after I retired.

I don't keep records on exactly where I was at when I retired, howeve.

I don't keep records on exactly where I was at when I retired, howeve.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A lot more, do not know exactly the numbers OP requested, except we do not take SS yet. We do not have a standard withdrawal rate, we take what we need/want. AND, we are only fixed income investors.

Souschef

Thinks s/he gets paid by the post

Years retired__11__

With pension or SS_both approx $70/yr__

Percentage increase_400%___

Withdrawal rate*_2%___

* of Nest Egg only, if known

With pension or SS_both approx $70/yr__

Percentage increase_400%___

Withdrawal rate*_2%___

* of Nest Egg only, if known

skipro33

Thinks s/he gets paid by the post

For those that have been retired for several years, what is the % increase cor decrease in your NW?

Years retired____

With pension or SS___

Percentage increase____

Withdrawal rate*____

* of Nest Egg only, if known.

Retired 7 years as of December 2020, retired December 2012

Pension at retirement age 56 Started SS for me at age 62, Started SS for DW at age 64.

Percentage increase (assuming you mean net worth) 35% of liquidity. Does not include real property

Withdrawal rate 0% (Pension and SS provides enough) However, RMD will be around $50,000 annual at the start. I'm 64 right now.

My raw income numbers are monthly;

Pension $5,600

My SS $2,122

DW SS $1,170

------------------

Inc Tot $8,892

No mortgage, pension pays medical

Something you DIDN'T ask; inheritance. Inheriting can really boost net worth outside your assumption NW grew out of investments and pension/SS underspending. I recently inherited a small amount; $100,000 range. I did not include that in my numbers. However, had I inherited it last year, I probably would have and not made the distinction as I'm doing now.

Last edited:

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,245

https://www.early-retirement.org/forums/f29/looking-back-at-the-big-financial-picture-105140.html was a similar thread you might find interesting.

Are you just curious, or are you thinking to use this information as guidance? The future is unlikely to mirror the past.

Are you just curious, or are you thinking to use this information as guidance? The future is unlikely to mirror the past.

iloveyoga

Thinks s/he gets paid by the post

In round numbers, our net worth has remained relatively stable, which is my goal at this stage of the game.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We’re all different so not sure what purpose it serves...

Years retired me 9+ years, DW 1+ years

With pension or SS no pensions, SS still 4-6 years away

Percentage increase about 70%, IOW portfolio is 170% of 9 years ago

Withdrawal rate* including unreinvested dividends 1.0% WR ranging from 0 to 1.7% (Roth conversions). This year and the next 4-5 will be a little higher due to Roth conversions, but WR will fall even lower once we stop conversions and start SS and RMDs. Yes, we should probably spend more...

* of Nest Egg only, if known.

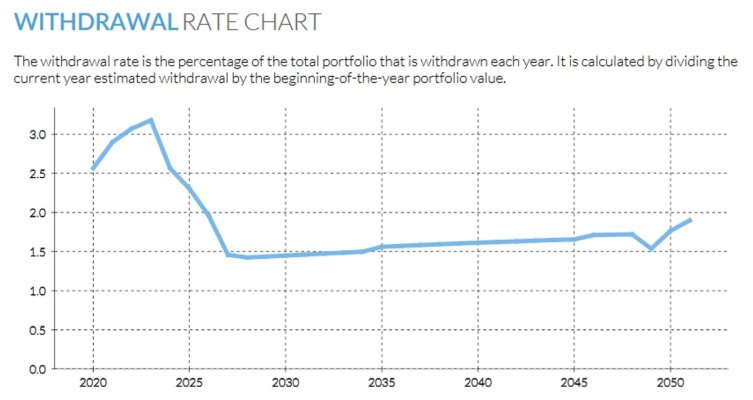

Here's what we're "supposed to" withdraw according to our plan, but we're nowhere near it because we don't spend anything l like what we're "supposed to."

Years retired me 9+ years, DW 1+ years

With pension or SS no pensions, SS still 4-6 years away

Percentage increase about 70%, IOW portfolio is 170% of 9 years ago

Withdrawal rate* including unreinvested dividends 1.0% WR ranging from 0 to 1.7% (Roth conversions). This year and the next 4-5 will be a little higher due to Roth conversions, but WR will fall even lower once we stop conversions and start SS and RMDs. Yes, we should probably spend more...

* of Nest Egg only, if known.

Here's what we're "supposed to" withdraw according to our plan, but we're nowhere near it because we don't spend anything l like what we're "supposed to."

Attachments

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It’s so dependent on when you retired and what markets did afterwards. We are currently after a very long bull market - no indication that the next decade will repeat. Not sure how other poster’s past experiences can inform.

Last edited:

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

Retired 7 years. DW gets her SS of $1400 monthly, mine will be 3k in a couple more years, been living on 3% withdrawals no pensions. Nest egg is up 30% since I retired.

You might look at firecalc or it’s evil twin and look at 10 year outcomes of portfolios assuming different withdrawal rates over different periods in history. That will give you a more realistic view.

Just out of curiosity I tried this at 3.5 and 4% withdrawal rates. It’s a pretty useful/informative exercise. There were several periods that the portfolio was down by 50% using 75% equities at 10 yrs.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,703

I retired ago today. The markets were crashing, so my portfolio's value was down, something which actually helped me quite a bit. Since then, it has nearly doubled (+93%). I am not old enough for SS or o get my frozen company pension. My WR is about 2%.

My curiosity was aroused by another thread. https://www.early-retirement.org/fo...days-for-2-retirees-106166-2.html#post2504740https://www.early-retirement.org/forums/f29/looking-back-at-the-big-financial-picture-105140.html was a similar thread you might find interesting.

Are you just curious, or are you thinking to use this information as guidance? The future is unlikely to mirror the past.

I'm 2 years retired, We're up about 23% in those two years even with the recent down market.

Yes, we had a great 2012 to 2017 where we had a double, but yep, that is no predictor of the future.

I'm very close to FRA and wife is has about 5 years to go. We should have zero problems. Ah, financially!

Last edited:

GravitySucks

Thinks s/he gets paid by the post

7 years retired.

Small SS survivors benefit for the last 2 years

4% - 5.5% WR

Up 40%

Small SS survivors benefit for the last 2 years

4% - 5.5% WR

Up 40%

CyclingInvestor

Thinks s/he gets paid by the post

Years retired : 14

With pension or SS : No pension, SS just started at 62

Percentage increase : 115%

Withdrawal rate : 4-5%

With pension or SS : No pension, SS just started at 62

Percentage increase : 115%

Withdrawal rate : 4-5%

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Retired over 21 years ago - OMG!

no pension, no SS yet.

Net worth and liquid investments have more than doubled - but cumulative inflation over 21 years is significant - like 55%.

Withdrawal rate - around 3%

no pension, no SS yet.

Net worth and liquid investments have more than doubled - but cumulative inflation over 21 years is significant - like 55%.

Withdrawal rate - around 3%

Last edited:

FWIW...

I've been retired 7 years. DW 4.

We each have small pensions that cover roughly 60% of spend.

SS is still many years away. DW is 60; I'm 59. We'll likely start at FRA (her) and 70 (me). Once we're both collecting, it will be roughly the same as the two pensions, maybe a bit more.

Withdrawal rate fluctuates around 2.5%, almost all of which comes from dividends. We do sell shares occasionally in taxable, but reinvest the same (or larger) in tax-deferred and tax-free. So in effect, it all comes from dividends.

Our combined portfolio is up 36% from the day I told my boss I was going to retire in 2013.

I've been retired 7 years. DW 4.

We each have small pensions that cover roughly 60% of spend.

SS is still many years away. DW is 60; I'm 59. We'll likely start at FRA (her) and 70 (me). Once we're both collecting, it will be roughly the same as the two pensions, maybe a bit more.

Withdrawal rate fluctuates around 2.5%, almost all of which comes from dividends. We do sell shares occasionally in taxable, but reinvest the same (or larger) in tax-deferred and tax-free. So in effect, it all comes from dividends.

Our combined portfolio is up 36% from the day I told my boss I was going to retire in 2013.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

For those that have been retired for several years, what is the % increase cor decrease in your NW?

Years retired____

With pension or SS___

Percentage increase____

Withdrawal rate*____

* of Nest Egg only, if known.

- 8 1/2 years..... Retired in Jan 2012 at age 56

- Started pension that is ~20% of annual spend in 2016

- Nestegg 2% higher today than when retired

- Part of nestegg went to new winter home (~10%), new garage at summer home (~6%), pay off mortgage on summer home (~10%), new vehicles, etc.

- NW is 25% higher today than when retired due to addition of winter home, new garage and mortgage payoff from nestegg

- WR for 2017-2019 was 4.6% (average of 2017-2019 withdrawals/retirement date balance)

- Once we start SS WR will be ~1.5% (withdrawals/retirement date balance)

Last edited:

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,567

Percentage of increase, are you talking NW, or just your portfolio growth?

calmloki

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We have rental property, so some will claim we are still working (at almost 71), but we are down to 1/2 the units we had and have been spending 1/2 the year in SoCal during the gray winter months and 1/2 in Oregon in the glorious summer, and do have a manager.

Years retired__10?

Using ten years, as by that time everything was paid off, including the home we bought in SoCal to use during the winter months and we were going south for the winter.

With pension or SS___SS sorta?

Ah. perils of unearned income(rentals). I currently get $202 SS after Medicare takes an enhanced chunk, while the Gal, who worked for others longer than I, gets $506 after Medicare subtractions. Pensions? nope.

Percentage increase____NW is up by 2.894 times in that 10 year period

Withdrawal rate*___What we need, which is pretty darn little. I know we spend more on state and federal income taxes than we spend on maintaining ourselves.

Years retired__10?

Using ten years, as by that time everything was paid off, including the home we bought in SoCal to use during the winter months and we were going south for the winter.

With pension or SS___SS sorta?

Ah. perils of unearned income(rentals). I currently get $202 SS after Medicare takes an enhanced chunk, while the Gal, who worked for others longer than I, gets $506 after Medicare subtractions. Pensions? nope.

Percentage increase____NW is up by 2.894 times in that 10 year period

Withdrawal rate*___What we need, which is pretty darn little. I know we spend more on state and federal income taxes than we spend on maintaining ourselves.

Last edited:

Retired over 21 years ago - OMG!

no pension, no SS yet.

Net worth and liquid investments have more than doubled - but cumulative inflation over 21 years is significant - like 55%.

Withdrawal rate - around 3%

Good point about inflation!

Similar threads

- Replies

- 65

- Views

- 9K

- Replies

- 15

- Views

- 868

- Replies

- 76

- Views

- 4K

- Replies

- 117

- Views

- 9K

Latest posts

-

-

-

-

-

In Your City - What Are The Most Desirable Neighborhoods and Why?

- Latest: RetiredAndFree

-

Best CD, MM Rates & Bank Special Deals Thread 2024 - Please post updates here

- Latest: Healthy Lifestyle

-