- Joined

- Oct 13, 2010

- Messages

- 10,767

My usual approach, to use the previous year tax software to plan the current year, won't work as well this time, as the rules have changed more than usual. Of course the last minute planning I do in late November will work... I'll have the 2018 tax software by then. That's the time of year I take actions that make a difference anyway.

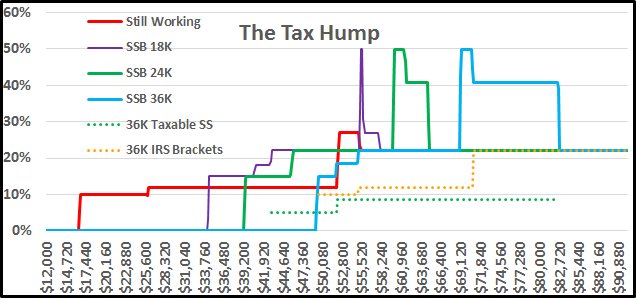

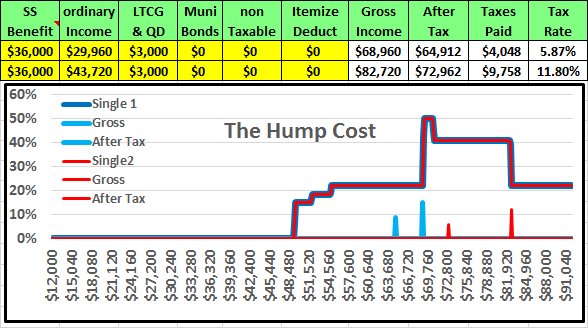

Rather than getting a spreadsheet developed with all the right formulas, I just do some what if trials in the tax software. This allows me to generate a hump diagram. Sometimes it makes sense to stay on the cheaper side of the hump, and other times when wanting to avoid the RMD torpedo, it makes sense to power through the hump and get as much as you can through the gauntlet before hitting the next marginal rate increase.

A couple of years ago I found a huge and complicated spreadsheet that did Federal taxes. It was locked so I couldn't delete the stuff I didn't need, and couldn't see how it worked, so I never really used it. My plan at the time was to eliminate everything except that which applied to me, simplifying a bunch, then have a much faster way to map the humps. But resorted to iterating tax software.

Rather than getting a spreadsheet developed with all the right formulas, I just do some what if trials in the tax software. This allows me to generate a hump diagram. Sometimes it makes sense to stay on the cheaper side of the hump, and other times when wanting to avoid the RMD torpedo, it makes sense to power through the hump and get as much as you can through the gauntlet before hitting the next marginal rate increase.

A couple of years ago I found a huge and complicated spreadsheet that did Federal taxes. It was locked so I couldn't delete the stuff I didn't need, and couldn't see how it worked, so I never really used it. My plan at the time was to eliminate everything except that which applied to me, simplifying a bunch, then have a much faster way to map the humps. But resorted to iterating tax software.