Probably discussed many times, but new to me.

Here's the thing... I'm not an investor in the normal sense of the word. Too conservative, and too old to take chances, so we put some money in IBonds a long time ago, when the rates were a little higher than they are today. Since the interest rate varies according to the CPI, I always wondered how it all averaged out.

Anyway, putting the numbers into a reverse interest rate calculator, the annual average... over about 11 to 14 years came out to a little over 5%.

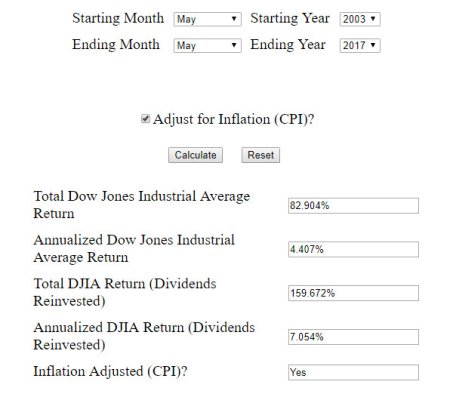

Now... I wonder what that might have been if I had invested the money into a "safe" investment other than the US Government, over the same period (let's say in 2003).

Your choice of "safe".

Your choice of "safe".

Here's the thing... I'm not an investor in the normal sense of the word. Too conservative, and too old to take chances, so we put some money in IBonds a long time ago, when the rates were a little higher than they are today. Since the interest rate varies according to the CPI, I always wondered how it all averaged out.

Anyway, putting the numbers into a reverse interest rate calculator, the annual average... over about 11 to 14 years came out to a little over 5%.

Now... I wonder what that might have been if I had invested the money into a "safe" investment other than the US Government, over the same period (let's say in 2003).