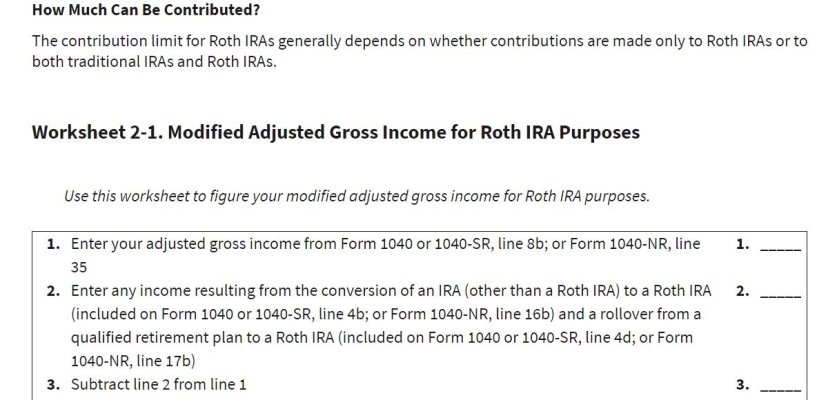

Based on what I’m finding online it appears that Roth conversion amounts are not included in one’s MAGI for the purpose of determining income limits for Roth IRA contributions.

Just want to confirm with the experts here that I’m understanding correctly and nothing has changed in the rules for 2020.

Thanks!

Just want to confirm with the experts here that I’m understanding correctly and nothing has changed in the rules for 2020.

Thanks!