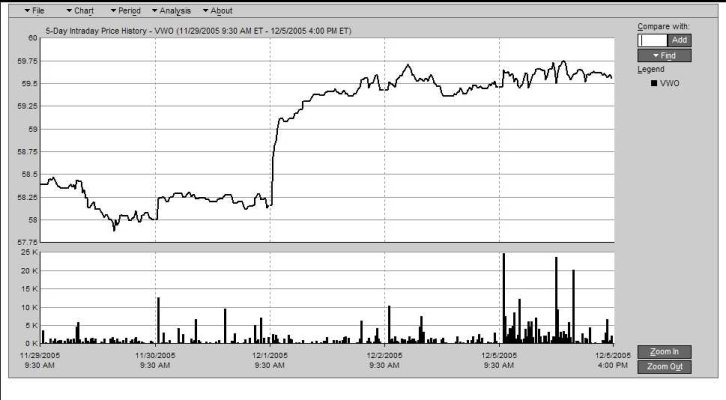

For tax reasons, I'm planning to "move" shares of Vanguard's VWO Viper from an IRA to a taxable account.

I'm not concerned with the small commissions I'd have to pay, to buy in taxable and sell in IRA, but the spread on this fund is large, and I don't want to pay it.

So, my plan is, to put a limit order in both accounts, one to buy, and the other to sell. I would literally sell to myself, if it works as planned.

I guess that if there's more buying than selling (other than from the institution that provides/destroys the creation units) then I would place my limit orders somewhere between the midpoint of the bid/ask spread, and the ask. I suppose I'd put the sell in first, then immediately put the buy in at the same price and number of shares.

If my first order gets filled before my second order is accepted, it would most likely be the market maker, since trading is relatively light. So, I want to put my first order in, far from NAV in case NAV moves before my second order is accepted. I'm thinking that if there's buying pressure, the spread may not center on NAV, but a little above it.

Example:

ASK 60.40

BID 60.00

Last 60.40

My guess of NAV: 60.10 to 60.20, but a moving target.

Place Sell at 60.35, then buy at 60.35.

Maybe if eveyone (other than market maker/creatn unit institution) is buying, I should instead place buy at 60.10, then sell, in case the market maker for some reason is "nice" and fills the unusual 60.35 sell? This is a Vanguard fund, not sure the market maker is a ruthless profiteer.

Opinions?

* To be more technically correct, true NAV but adjusted for expectations of price changes in closed markets because of today's changes in open markets.

I'm not concerned with the small commissions I'd have to pay, to buy in taxable and sell in IRA, but the spread on this fund is large, and I don't want to pay it.

So, my plan is, to put a limit order in both accounts, one to buy, and the other to sell. I would literally sell to myself, if it works as planned.

I guess that if there's more buying than selling (other than from the institution that provides/destroys the creation units) then I would place my limit orders somewhere between the midpoint of the bid/ask spread, and the ask. I suppose I'd put the sell in first, then immediately put the buy in at the same price and number of shares.

If my first order gets filled before my second order is accepted, it would most likely be the market maker, since trading is relatively light. So, I want to put my first order in, far from NAV in case NAV moves before my second order is accepted. I'm thinking that if there's buying pressure, the spread may not center on NAV, but a little above it.

Example:

ASK 60.40

BID 60.00

Last 60.40

My guess of NAV: 60.10 to 60.20, but a moving target.

Place Sell at 60.35, then buy at 60.35.

Maybe if eveyone (other than market maker/creatn unit institution) is buying, I should instead place buy at 60.10, then sell, in case the market maker for some reason is "nice" and fills the unusual 60.35 sell? This is a Vanguard fund, not sure the market maker is a ruthless profiteer.

Opinions?

* To be more technically correct, true NAV but adjusted for expectations of price changes in closed markets because of today's changes in open markets.