I’m about to switch my investment/taxable account and IRA’s from a wealth management company to a DIY plan.

Could you please share your asset allocation, portfolio, and avg return percentage for:

1) Past Month (October 2021)

2) Past 6 Months

3) Year To Date

4) Past 3 Years

5) Past All Years

As others have said, I don't think you can get much out of other investors' info. If they are indexers, or someone who subscribes to a 2 or 3-fund portfolio, you can find out the info yourself using a tool such as Portfolio Visualizer, and selecting whatever asset allocation you like to see. A high stock AA will do well in a bull market, and stinks in a bear market. No mystery there.

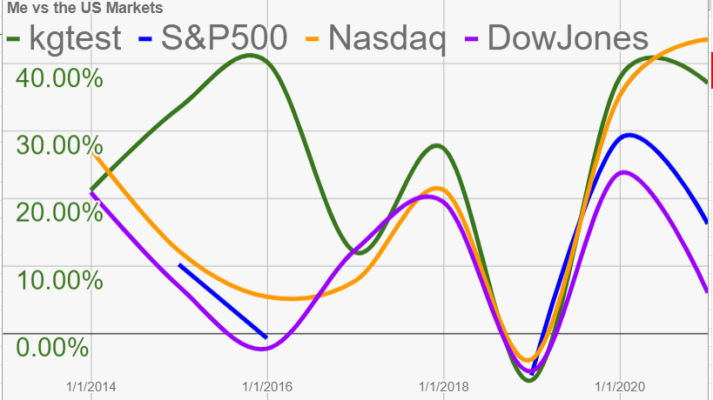

On the other hand, there are active investors like myself, who has around 100 stock positions, and up to 30-40 option positions open at one time, and perhaps 10 MFs, plus I bond and Stable Value funds in 401k. And all these are spread out in more than a dozen accounts (his/her 401ks, IRAs, Roth IRAs, after-tax accounts, Treasury accounts, etc...)

All the above info needs a spreadsheet, and even if you have it, what can you do with it? I made many trades, and that's past info. I also practice Tactical AA, and vary my stock AA according to the market condition.

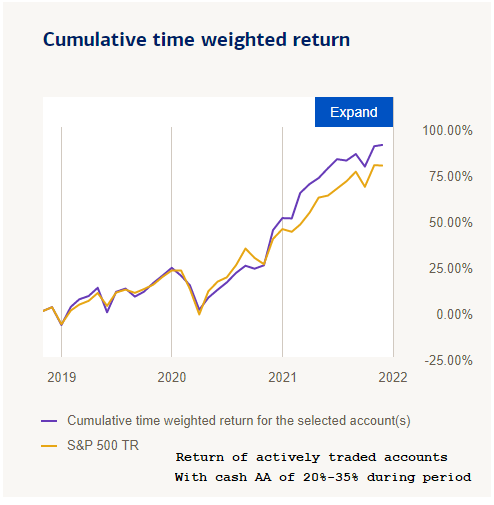

As for actual returns, I will share a chart I captured off of my brokerage screenshot. They computed the return of my and my wife's rollover IRAs, which I used for most of my trading. These 2 accounts are 74% of our investable assets. The stock AA of these 2 accounts is currently 64.4%.

These 2 accounts beat the S&P so far, but when blended in with the remaining accounts which are not actively traded, the overall return trails the S&P a bit. The overall stock AA of all investable assets is currently 62.6%.

I share this just to show that individual info may not help you much. I could do really well if I chose good stocks, or very poorly with lousy stocks. I could do well this year, but may crash the next.

I read the chart to say that the portfolio you graphed delivered, over those two years, about the same as the S&P total return. Right? If so, sorry to say I don’t think it counts for much. Anyone buying an S&P fund could have done as well with better diversification = less risk. Am I not reading it right?

I read the chart to say that the portfolio you graphed delivered, over those two years, about the same as the S&P total return. Right? If so, sorry to say I don’t think it counts for much. Anyone buying an S&P fund could have done as well with better diversification = less risk. Am I not reading it right?