You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sold all my stocks

- Thread starter Running_Man

- Start date

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is it testosterone that makes one greedy when others are fearful, and vice versa?

Some years ago, I read an article that claimed women made better traders than men, as the latter could not keep a cool head. But I am a man (and also like women a lot). What traits I share with most women are that I do not care about spectator sports nor fast cars, and preferring drama to action movies, etc...

I was more thinking that several guys here (I'm included) seem to delight in beating the market. Timing can be used or not. At least I think the ones I read here are men from certain clues or maybe avatars.

I'm not sure I've read a woman's post here about timing the market or famous moments in personal investing.

I too don't care about spectator sports (well I did watch the Super Bowl though) nor fast cars, and prefer dramas to action movies, and women (look but don't touch).

OK, so now I'm nervous....

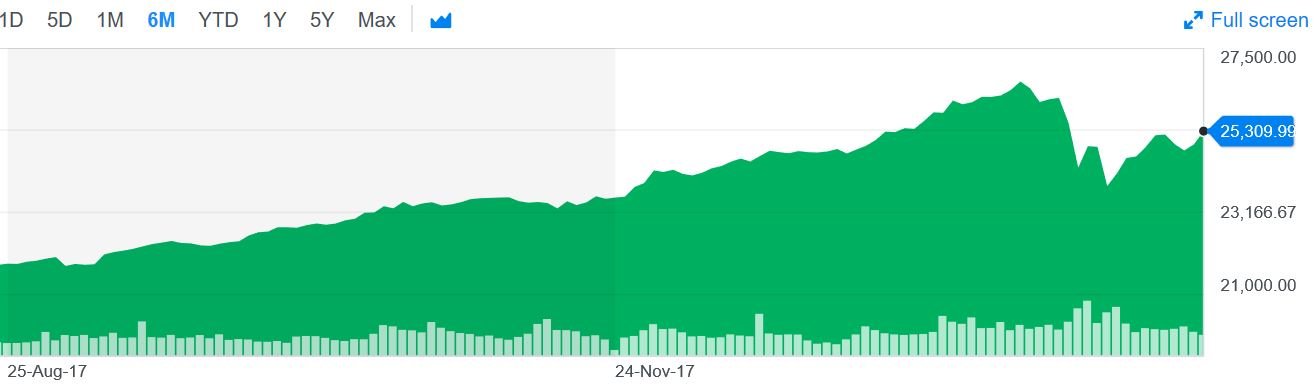

From another thread: Would selling right now be such a poor decision? (dated 2-16-18)

Getting nervous?

Yep.

GravitySucks

Thinks s/he gets paid by the post

OK, so now I'm nervous....

The scary part is how many names you never see posting here anymore.

Did they go back to work or did they 'win' the game?

copyright1997reloaded

Thinks s/he gets paid by the post

OK, I am ready to sell everything now.

Hold on, I just found another one of your posts from that thread:

(Emphasis added.)The following is my fears of what may occur, hopefully I am wrong on this.

At some point shortly the market will cease going down, as most of the weak hands have been shaken out.

As the promises to fix the problem by the present administration will overshadow concerns of the potential ineffectiveness. However by fall, the need to sell US treasury notes for the actual promises given will be showing up as a massive global strain while at the same time state governments will be reviewing their upcoming state budgets and those will be bleeding red ink, causing a crisis in municipal and government bonds.

At this point faith in the recovery will evaporate and with it the stock market prices as they collapse in the fourth quarter to a new bear market low. The ability of spending a few trillion dollars will come as a process that was able to defer but not prevent the implosion of 50 trillion plus in imploding debt assets. However, for a time I think we will be better...

So it appears you aren't perfect?

RAE

Thinks s/he gets paid by the post

Thank you, Running Man. And please keep us updated as to what you see in the markets and what you are doing, as some of us are interested. For those folks who are not interested, or can't/won't tolerate any form of market timing, you are free to ignore this thread if you want to.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The scary part is how many names you never see posting here anymore.

Did they go back to work or did they 'win' the game?

They got tired of being called dirty market timers.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

Hey, I'm flying the Dirty Market Timer flag and have no problems be called names.

I treat it like a profitable hobby.

And I love threads like this one because it helps me gauge Investor Sentiment --- not just from the OP, but from all the Respondents, too.

I treat it like a profitable hobby.

And I love threads like this one because it helps me gauge Investor Sentiment --- not just from the OP, but from all the Respondents, too.

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

Dang, I know Running_Man is probably right but I don’t have the guts to sell. When I look at my spreadsheet in 2007 I had 386k and now it shows 1.6M.

Haven’t really sold anything in my life.

Haven’t really sold anything in my life.

Last edited:

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

Since I started investing in July 1989 (meaningless I know) the S&P 500 has averaged 9.965%. Seems about right and I hope for about the same going forward.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

No, I am not perfect, as a matter of fact to do this you better be willing to admit when you are wrong. I am not looking to be perfect, I am looking to be conservative actually.OK, I am ready to sell everything now.

Hold on, I just found another one of your posts from that thread: (Emphasis added.)

So it appears you aren't perfect?

At the time I was feeling there would be a major rally from that bottom, and following a decline after a major rise through late 2009 and early 2010 I did not envision a scenario where the Federal Reserve would be willing to purchase 4 trillion of bonds and the US government be willing to trillion dollar deficits. In late 2009 I stayed in stocks but purchased long term puts yet by early 2010 I realized the FED was all in for a stock market rally and gave up on puts and increased my stock holdings up towards 50% and then have slowly reduced over time to 25% last October, where I had planned to hold it.

There have been several moments these past weeks where I felt like Steve Carell in the Big Short, when he visited mortgage lenders in Miami.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I do not think the market will be going up like it has been in the last couple of years. In fact, very few think so. However, I think some sectors will be carried up due to their cyclical nature, and I want to ride them for a little longer.

I guess I am more of a stock picker than market timer.

I think men in general are more passionate about whatever they do than women. Men are more involved and devoted. Not sure what drives it. Is it all testosterone related?

I guess I am more of a stock picker than market timer.

I was more thinking that several guys here (I'm included) seem to delight in beating the market. Timing can be used or not. At least I think the ones I read here are men from certain clues or maybe avatars.

I'm not sure I've read a woman's post here about timing the market or famous moments in personal investing.But I could be very wrong about this and all one of these ladies has to do is step up and prove me wrong. Go ahead, make my day.

I know I'm on very thin ice here and please nobody should take me too seriously.

I too don't care about spectator sports (well I did watch the Super Bowl though) nor fast cars, and prefer dramas to action movies, and women (look but don't touch).

I think men in general are more passionate about whatever they do than women. Men are more involved and devoted. Not sure what drives it. Is it all testosterone related?

Thank you, Running Man. And please keep us updated as to what you see in the markets and what you are doing, as some of us are interested. For those folks who are not interested, or can't/won't tolerate any form of market timing, you are free to ignore this thread if you want to.

RAE I share your sentiments 100 %. Runningman has been generous in offering his action plan in a humble and straightforward way yet many of the comments are at best intolerant. I am a relative newcomer and have up till this point been generally impressed by the spirit and quality of posts here but this thread has taken my impression down a notch or two. You have to have pretty thick skin to say anything that goes against the grain in this forum.

Last edited:

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

I understand your feelings as I'm sort of mid-negative myself which is why I'm down from 60/40 to 50/50 as of December 1st. OK so I'm not so extreme and being still exposed makes me conflicted ... do I hope for more down so I can get back in at 60/40 and declare myself smart ... or do I hope for continued up and wish I had stuck with 60/40? Some of us cannot win in our own minds.

In the corrections of 1962 and 1987, the time from peak to a good sell point was 3 months. Will history repeat? You can easily see charts of this on Yahoo looking at the SP500 (^GSPC symbol).

One thought for you. I believe it is hard to declare yourself on these social network forums because you inevitably get people who are going to be negative towards your move. In this case it is probably because people have a vested interest in seeing the opposite outcome and they become defensive. This is a natural human instinct and some of us cannot help ourselves. But do you want to hear these negatives? I would not.

A final question if it is not too intrusive. What is your plan on getting back into stocks and what percentage would you move? Thanks for sharing.

When I decide to get back in, I would aim to get 25% back in as soon as possible.

Getting back in when the market has fallen is quite easier than when the market is heading up, most people see the value when the market is significantly down, as I stated one must be willing to admit they are wrong, I expect the market to respond in short order here to the down side, a new stock market high would mean I was wrong in my assessment and I would get my 25% back in. As that is 4-5% higher than my sell point, that would lower my portfolio results by one - 1.5% percent approximately this year, than if I never would have done this.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Why would you hope you're wrong?

If the market continues to go up or meander on from here I will be fine and so will most other people. If there is a decline of the epic proportion, there are too many negative consequences from all aspects of society that occur that are only sad for too many people.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

If this is in taxable account, you'll also be lower due to the tax on your capital gains that has to be paid. And depending on health care subsidy, that gain may also push you over the cliff which would also lower your results. But hey, for every seller there's a buyer, one of them will be correct. Sometimes both end up being correctWhen I decide to get back in, I would aim to get 25% back in as soon as possible.

Getting back in when the market has fallen is quite easier than when the market is heading up, most people see the value when the market is significantly down, as I stated one must be willing to admit they are wrong, I expect the market to respond in short order here to the down side, a new stock market high would mean I was wrong in my assessment and I would get my 25% back in. As that is 4-5% higher than my sell point, that would lower my portfolio results by one - 1.5% percent approximately this year, than if I never would have done this.

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,196

I completely understand folks deciding to get out of the market now. No reason for folks to take it personally. At times I am tempted, particularly with my 401K having a Stable Value fund that is now yielding over 3% with the principal guaranteed. I'll admit that part of me is a little greedy, which is why I'm going to keep about 40% of my AA in equities. But I have also modeled what would happen to that 40% should the market tank, and I can still live with the result.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

When I decide to get back in, I would aim to get 25% back in as soon as possible.

Getting back in when the market has fallen is quite easier than when the market is heading up, most people see the value when the market is significantly down, as I stated one must be willing to admit they are wrong, I expect the market to respond in short order here to the down side, a new stock market high would mean I was wrong in my assessment and I would get my 25% back in. As that is 4-5% higher than my sell point, that would lower my portfolio results by one - 1.5% percent approximately this year, than if I never would have done this.

I'm glad you have a plan for both market directions. Sounds sensible to me.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,313

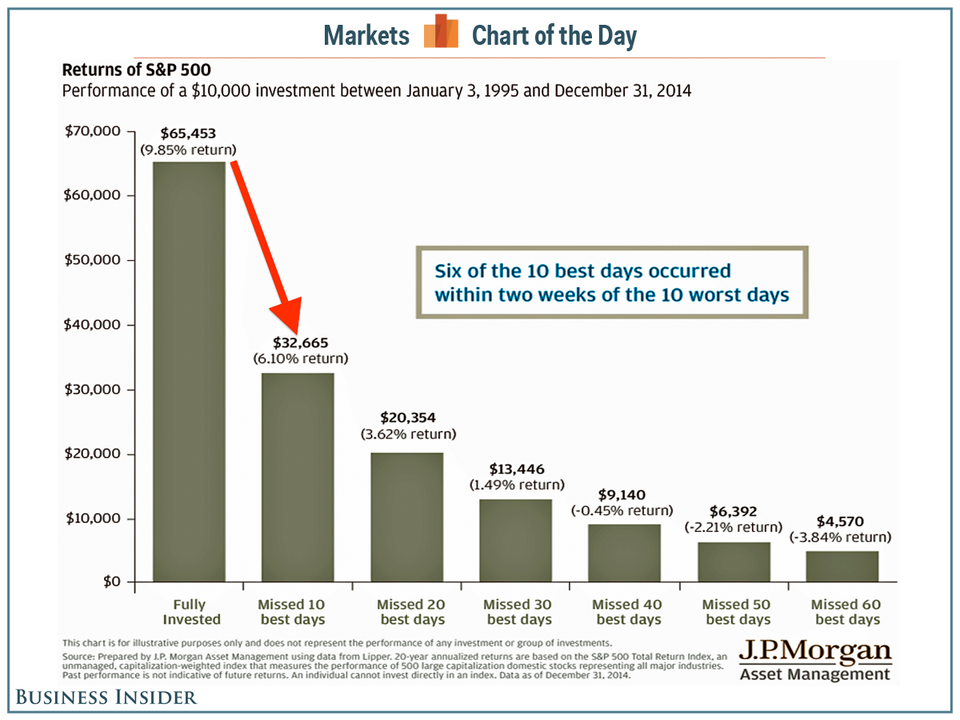

Market timers indeed avoid worst days, but more importantly, they miss out on best days too where most of your returns will actually come from. Just look at what happens if you only miss 10 best days. Your overall return goes from 9.8% to 6.10%and if you miss 30 best days, it's money in the mattress.

This chart is interesting but not that relevant... those 10 days are going to be spread over a long time period... it would be impossible for someone to sell everything just before those 10 days and be in the rest of the time...

Now, this chart says that those 10 days are mostly within 2 weeks of the worst days.... so, if you want to market time keep all money in cash... when the market takes a big tumble invest everything and wait two weeks... then sell everything and wait for the next time...

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

BUT, if you have enough for your own lifestyle, a good buffer, and still do not care, as one gets older capital preservation and sleeping well is a lot more important. at least it is to me. We could handle a 12% inflation for 15 - 20 years and still not need to worry.

We feel the same. Even keeping up with inflation, and we should do a bit better than that, our 30 year safe withdrawal rate would be 3.33% (100/30 years), which is much more than we plan to spend anyway. Every day is a vacation day in the Bay Area for us so we happy with that kind of lifestyle. We feel pretty fortunate to have the life we do and be able to live below our means in retirement so no need to take on additional risk for us.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

That has been back-tested and it doesn't quite work out that way either.Now, this chart says that those 10 days are mostly within 2 weeks of the worst days.... so, if you want to market time keep all money in cash... when the market takes a big tumble invest everything and wait two weeks... then sell everything and wait for the next time...

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,464

When I hear "epic proportions" relative to the stock market I assume we're not talking about a correction or 'The Great Buying Opportunity of 2008', but more of a repeat of the Great Depression of 1929.

I just don't see that. IMO the past few weeks have returned us to a more stable market with somewhat high valuations, suddenly realistic interest rates and perhaps some healthy, low inflation on the horizon. Back to normal IMO.

But what do I know. I'm staying the course but plan to revisit this thread in December!

I just don't see that. IMO the past few weeks have returned us to a more stable market with somewhat high valuations, suddenly realistic interest rates and perhaps some healthy, low inflation on the horizon. Back to normal IMO.

But what do I know. I'm staying the course but plan to revisit this thread in December!

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

I just don't see that. IMO the past few weeks have returned us to a more stable market with somewhat high valuations, suddenly realistic interest rates and perhaps some healthy, low inflation on the horizon. Back to normal IMO.

Well, I just don't see that.

Two weeks does not cure all problems.

My crystal ball shows taper tantrums with each rate hike going forward. The only question is which one will push us over the cliff?

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,464

Well, I just don't see that.

Two weeks does not cure all problems.

My crystal ball shows taper tantrums with each rate hike going forward. The only question is which one will push us over the cliff?

Yeah. I worded that poorly.

My point was that I see things becoming a bit more stable/normal with the usual ups and downs, corrections, rallies, rate hikes, inflation, taper tantrums and even a good ol' fashioned 6 hour flash crash.

The usual stuff.

I'm just struggling to see where a market event of 'epic proportions' is on the horizon.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

I'm just struggling to see where a market event of 'epic proportions' is on the horizon.

True, that is a bold call.

Similar threads

- Replies

- 19

- Views

- 542