Graybeard

Full time employment: Posting here.

- Joined

- Aug 7, 2018

- Messages

- 597

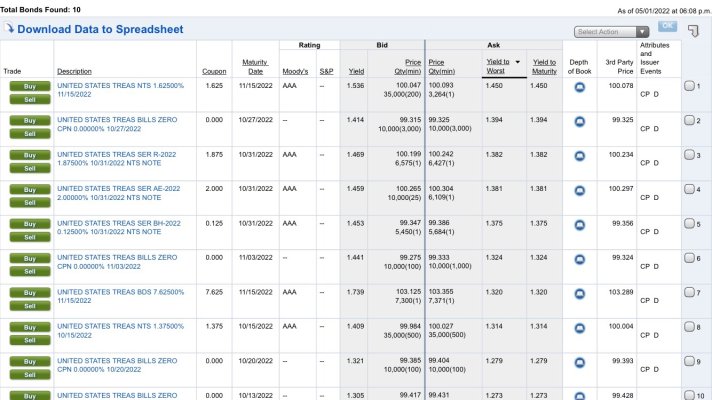

Either in my taxable or rollover IRA or both accounts I am going to buy some 3 month and 6 month T bills, I need to stop the nav bleeding in bond funds. I went to Vanguard's site and looked at what was available. The cutoff date is 5/2 for both bills and I only have money in my taxable account's settlement fund.

My 1st question is does the money for the purchase have to be in the settlement fund or can I sell shares from a mutual fund to make the purchase? Maybe I can buy them in the rollover IRA from a mutual fund like when exchanging from fund A to fund B? I suspect the money needs to be in the settlement fund but not 100% sure.

My next question is the next auction for 3 and 6 month bills will be announced 5/5 and auctioned 5/9. Is there a website that has an estimate of what the coupon might be or do I have to wait for it to show up in the Vanguard purchase screen when it becomes available?

Thanks.

My 1st question is does the money for the purchase have to be in the settlement fund or can I sell shares from a mutual fund to make the purchase? Maybe I can buy them in the rollover IRA from a mutual fund like when exchanging from fund A to fund B? I suspect the money needs to be in the settlement fund but not 100% sure.

My next question is the next auction for 3 and 6 month bills will be announced 5/5 and auctioned 5/9. Is there a website that has an estimate of what the coupon might be or do I have to wait for it to show up in the Vanguard purchase screen when it becomes available?

Thanks.