TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

I guess it's me, but the answers to these questions are not obvious from the terms they use, and I haven't found a good help or tutor topic that answers my questions.

Very simple, in 2011 I did a Roth conversion of $32,000 from one Vanguard fund to another.

Questions:

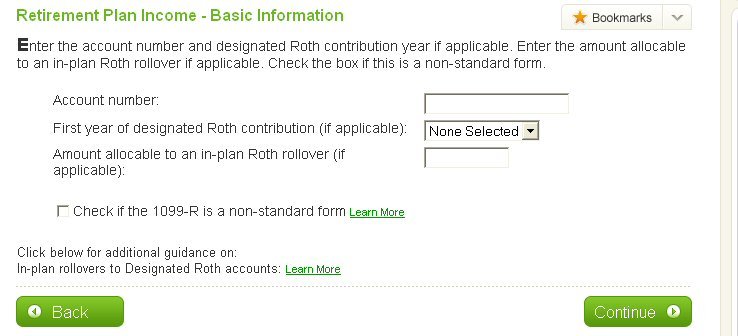

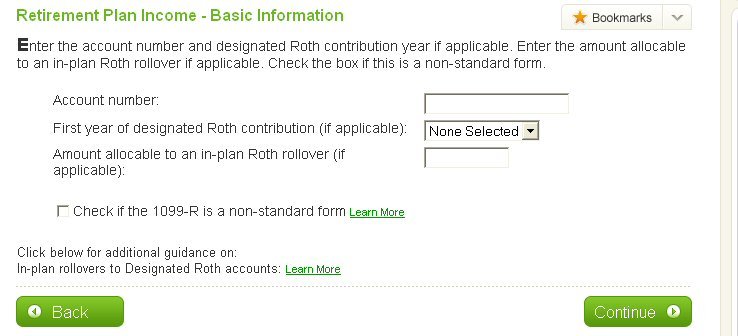

First year of Roth contribution -- 2011? The year that this contribution is for, or the first year that a contribution was made to that account??

Amount allocable to an in-plan Roth rollover: $32,000 or $0? Is this an in-plan Roth rollover, because it's all Vanguard or is this a new term related to 401 plans??

Thanks.

Very simple, in 2011 I did a Roth conversion of $32,000 from one Vanguard fund to another.

Questions:

First year of Roth contribution -- 2011? The year that this contribution is for, or the first year that a contribution was made to that account??

Amount allocable to an in-plan Roth rollover: $32,000 or $0? Is this an in-plan Roth rollover, because it's all Vanguard or is this a new term related to 401 plans??

Thanks.