VanWinkle

Thinks s/he gets paid by the post

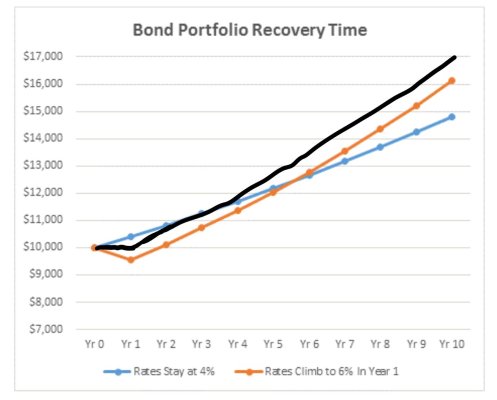

I read this interesting article from a very intelligent poster on Bogleheads concerning the rising rates and how they affect a long term investor.

https://www.bogleheads.org/forum/viewtopic.php?p=6286231#

The idea that bond funds lose money is tied to short term thinking

about a long term investment. Short term bond funds will also make

money based on the interest rates of the bonds purchased within the

fund.

VW

https://www.bogleheads.org/forum/viewtopic.php?p=6286231#

The idea that bond funds lose money is tied to short term thinking

about a long term investment. Short term bond funds will also make

money based on the interest rates of the bonds purchased within the

fund.

VW