Short-term investment

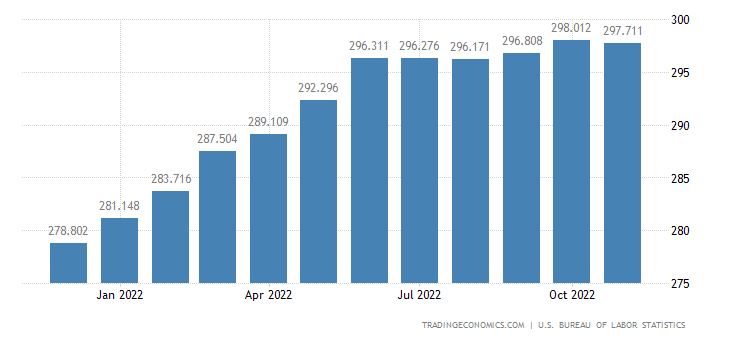

... So I’d guess the variable rate at the May reset will be lower than the current 6.48%, but most likely will still be at least 1.8%, based on 0.15% monthly inflation on average over the six months. That’s a conservative estimate.

Add on the fixed rate of 0.4% and you can conservatively estimate an annualized return of about 2.2% in the second six months. That creates a total return of about 4.54% for one year (6.89% + 2.2% / 2 = 4.54%) Remember, this is a conservative estimate. If inflation runs higher, your return would be higher. If inflation runs at 0.4% from December to March, the new variable rate would be 3.8%. Add on the fixed rate and you get to 4.2%. Your total return after one year would be about 5.5%.

But … redeeming an I Bond after 12 months will incur a three-month interest penalty, wiping out more than 1% of that return. ...

Conclusion. If your only interest in I Bonds is a quick one-year investment, you might want to look at competitive nominal investments like one-year bank CDs, online savings accounts or one-year Treasury bills. If inflation moderates, the returns could be similar but without the three-month interest penalty. The advantage of an I Bond is long-term inflation protection. If you aren’t concerned about inflation in the long term, look elsewhere.

But if you remain interested in the I Bond for one year, then I’d suggest using TreasuryDirect to set a purchase date later this month, maybe Jan. 27, to lock in January as your starting month. You could then redeem early in January 2024. ...