Ahh, Vanguard - just got off the phone with them today. I had an employer IRA that had contracted with Vanguard to manage their employee retirement accounts. I also have a personal SEP IRA with Vanguard. I no longer work for said employer and in the process of consolidating my financial matters before I pull the plug for good (yes - really retire!!!) I wanted to rollover said employer IRA to my SEP IRA.

That took a 30-45 minute phone call with two VG reps because there is a 'wall' between the financial support personnel. I also had to sign a document and send it via snail mail to VG so they could then cut a check and internally mail it to the other VG side. I currently live overseas, so this is taking some time and the funds are in 'limbo.'

Today I get an email that says the funds will be deposited into the MMF? huh

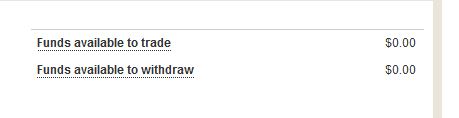

? The settlement account is in the MMF. My SEP IRA is not invested in the MMF. I log in and see they've opened a MMF in my SEP IRA. I waited several hours to call them (I'm six hours ahead).

Here's their explanation: because you did not 'explicitly state' you wanted those employer IRA funds to go to the fund you have in your SEP IRA, we had to place it in the MMF.

I was not happy and let them know it. In the 30-45 minutes phone call and in the documentation I signed, it did not state that I had to explicitly state I wanted those funds to go into the current fund chosen for the SEP IRA. I would assume they would put the funds in what is there now as a default unless I specified otherwise (I only have one fund in the SEP IRA - a Target Retirement fund).

So, I now have to wait another day, exchange the funds from that MMF to the other fund I have and that will happen the next day.

Now I need to go over to the "I'm not happy with USAA thread" and complain there as they are doing silly stuff, too....

Wow, I can see how all of your time as a retiree could be taken up with these issues and them complaining about them on a board... ;-)