I am planning my end-of-year moves for my Vanguard accounts, where I have the majority of my assets. I have some cap losses harvested in March that I want use.

My target asset allocation is 50/50. Of my non-cash portfolio value, taxable = 60% and tax-deferred = 40%, more lopsided that it was in March!

My taxable holdings are below (distribution as % of taxable accounts). My plan was to use the cap losses to get rid of the VTV and VXF (simplify!).

[FONT="]VG Balanced Idx Fund Adm Shares ...... VBIAX .......... 1%

VG Tax-Managed Bal Fund Adm ........... VTMFX ..........1%

VG Total Stock ETF ............................ VTI ............ 44%

VG Value ETF .................................... VTV ............. 2%

VG Growth ETF ................................. VUG ............ 36%

VG Extended Market ETF .................... VXF .............. 4%

VG FTSE All World EX-US EFT .............. VEU ............ 11%

[/FONT]

Earlier in the year I intended to use those proceeds to buy more VEU (I'm low in international exposure) but now, to hit my 50/50 asset allocation, I need to put bonds in my taxable account.

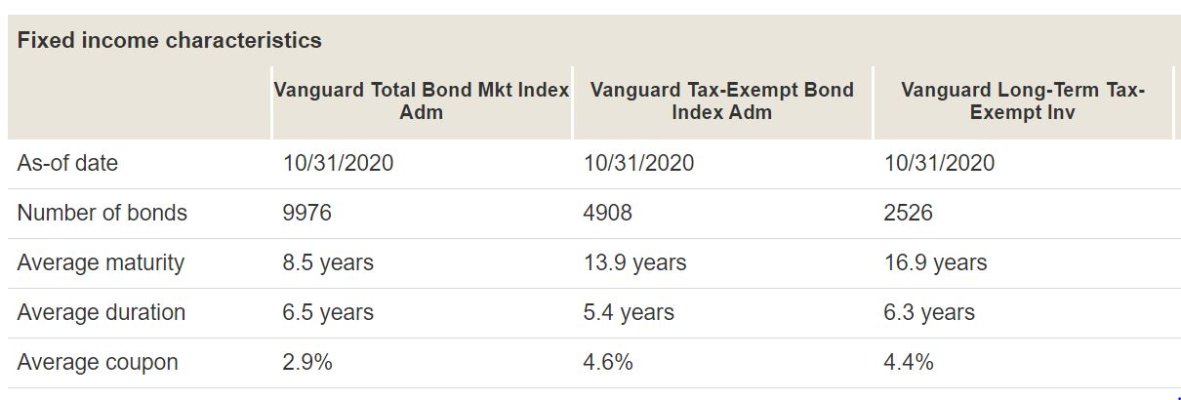

The Total Bond and Total International Bond funds are possibilities but I really don't want to generate taxable income. And the other consideration is that I'm trying to slim down the number of holdings, working toward a KISS portfolio within the next few years. (The harvesting in early 2020 got rid of four funds -- yay!)

Thoughts about how to add bonds to my taxable accounts?

BTW, In my tax-deferred accounts (IRA, Roth IRA, inherited IRA) I hold Inflation protected Securities, Wellington and Wellesley. They need to be cleaned up but that's the next project. I need to learn more about bonds.

My target asset allocation is 50/50. Of my non-cash portfolio value, taxable = 60% and tax-deferred = 40%, more lopsided that it was in March!

My taxable holdings are below (distribution as % of taxable accounts). My plan was to use the cap losses to get rid of the VTV and VXF (simplify!).

[FONT="]VG Balanced Idx Fund Adm Shares ...... VBIAX .......... 1%

VG Tax-Managed Bal Fund Adm ........... VTMFX ..........1%

VG Total Stock ETF ............................ VTI ............ 44%

VG Value ETF .................................... VTV ............. 2%

VG Growth ETF ................................. VUG ............ 36%

VG Extended Market ETF .................... VXF .............. 4%

VG FTSE All World EX-US EFT .............. VEU ............ 11%

[/FONT]

Earlier in the year I intended to use those proceeds to buy more VEU (I'm low in international exposure) but now, to hit my 50/50 asset allocation, I need to put bonds in my taxable account.

The Total Bond and Total International Bond funds are possibilities but I really don't want to generate taxable income. And the other consideration is that I'm trying to slim down the number of holdings, working toward a KISS portfolio within the next few years. (The harvesting in early 2020 got rid of four funds -- yay!)

Thoughts about how to add bonds to my taxable accounts?

BTW, In my tax-deferred accounts (IRA, Roth IRA, inherited IRA) I hold Inflation protected Securities, Wellington and Wellesley. They need to be cleaned up but that's the next project. I need to learn more about bonds.

Last edited: