daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

We've seen the downsides of bond index funds mentioned multiple times, but what about active funds, for example BCOIX? A cheap ER, does this avoid the issues that plague the bond index funds or not really?

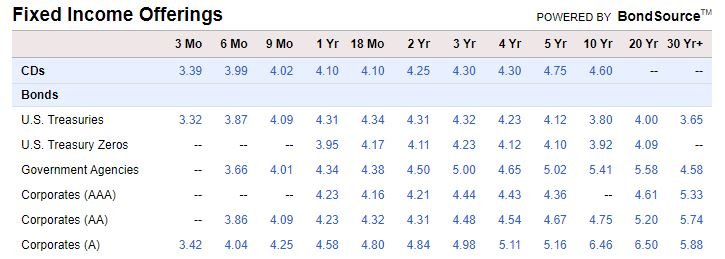

Check out the yield compared to short term Treasuries, which have no risk of principal if you hold to maturity.

The only way you are going to make money in bond funds over the individual bonds discussed in this thread is if we have a sudden, big drop in interest rates before you can buy back into your bond fund (if you choose to do that once rates drop or level off). The more rates go up, the riskier it is right now to hold onto the funds filled with low yield bonds, like the ones Freedom56 has pointed out, some with yields under 1%. The more rates go up, the less those bonds are worth, and lower the NAV of your fund will go.