We are doing a test right now of the Morgan Stanley wealth management group. In a year or two we will be able to compare their results to our various index and managed mutual funds. ...

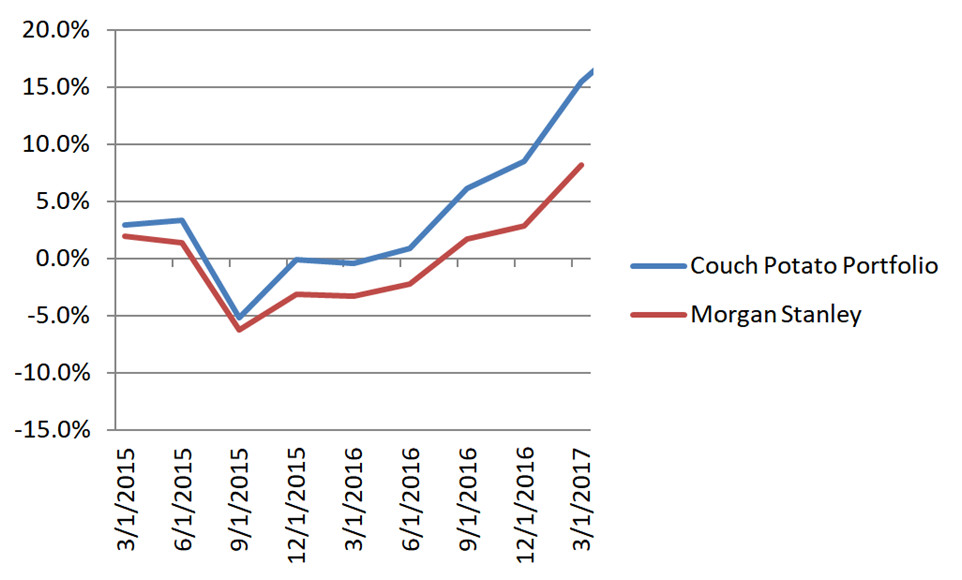

An important point in this post: A few months is an impossibly short time for evaluation of any kind of investment strategy. When I do evaluations, I don't even pay attention to the numbers for the first couple of years. This is for diversified strategies; a rifle-shot sector strategy needs longer as sector performance can take years to really show its stripes. For grins, here is real data comparing a particularly bad Morgan Stanley salesperson with a simple index portfolio of about 2/3 US total market and 1/3 international total market:

Most of performance is luck. If you look here: S&P SPIVA gateway:

https://www.spglobal.com/spdji/en/spiva/#/

you will see that roughly 30-40% of managers are winners over one year, but that number is close to cut in half in the second year, and so on. When you get out to 5 or10 years it is a tiny percent who are still winning.

So why not hire the lucky managers? Short version: no one knows how to spot them ahead of time. These reports: S&P Persistence gateway:

https://www.spglobal.com/spdji/en/indexology/core/persistence-scorecard/ pretty much nail the coffin closed. Here's one of the top academics explaining: Dr. Kenneth French on picking a manager:

https://famafrench.dimensional.com/videos/identifying-superior-managers.aspx

... I’ve been researching a lot since then and feel like I could/should switch to a low fee ETF/other but my account with my wealth management company is performing better (including fees) than most ETF’s I’m tracking as well as the S&P 500. ...

So, you're on the right track here. Your current portfolio may well be beating the S&P right now, but that is not predictive. So, yes, take the money and run! Be grateful for your good luck.

... When in a bull market, the one who want to run risk is a winner ...

This is truth, but far from the whole truth. There are many who run risks who

do not win. They do not post this news on the internet, either, so you do not get the whole picture. Nassim Taleb calls this "silent evidence" and uses this story:

"Diagoras, a nonbeliever in the gods, was shown painted tablets bearing the portraits of some worshippers who prayed, then survived a subsequent shipwreck. The implication was that praying protects you from drowning. Diagoras asked, “Where are the pictures of those who prayed, then drowned?”

The other factor here is that big wins can only come in non-diversified portfolios. Another guru, William Bernstein, advises:

“Do you think that by choosing a portfolio of only a few stocks that you hope will score big, you are maximizing your chances of becoming wealthy? Indeed you are, but you are also maximizing the chances of a retirement of cat food cuisine”

(on investing for retirement) “Make no mistake about it: The object of this particular game is not to get rich – It’s to not get poor.”

Some good reads:

"If You Can" by William Bernstein

https://www.etf.com/docs/IfYouCan.pdf (free 16 page download)

"The Coffee House Investor" by Bill Schultheis

https://www.coffeehouseinvestor.com/ (This is Bill's first book; read it before reading his second one.)

"The Bogleheads Guide to Investing" by Taylor Larimore et al

https://www.amazon.com/Bogleheads-Guide-Investing-Taylor-Larimore/dp/0470067365