I rolled the dice and bought some TDOC last week after it dropped. I figured that the drop would be an overreaction, but today I decided that I had not done my homework and that my thesis was entirely based on the assumption that people overreact. So I sold out today and booked a 14% gain.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What stocks are you shopping?

- Thread starter gcgang

- Start date

F.I.R.E User

Thinks s/he gets paid by the post

None. Continuing my regular phase of low cost index funds.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

acct #1) Cumulative list of purchased shares: T (25 sh), ABBV (10 sh), BX (10 sh), MDT (14), ENZL (10), SCHD (10), SPYD (15).

acct #2) Increased positions in MSFT, USRT, SCHE, SCHF, SCHG.

acct #3) Increased positions in VXF, SCHG, VXUS.

acct #2) Increased positions in MSFT, USRT, SCHE, SCHF, SCHG.

acct #3) Increased positions in VXF, SCHG, VXUS.

copyright1997reloaded

Thinks s/he gets paid by the post

Dang, drop half a million on two names. Go big or go home I guess.

XOM would have me a little nervous...I liked it better when it was $55...I really liked Microsoft when it was $30 a share but nobody else did.

I bought Mr. Softie at $31.40 in April 2010.

ETA: Still own it.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

DIS is only 0.16% above strike of the put that I sold, so I may be a proud owner of DIS soon.

aja8888

Moderator Emeritus

DIS is only 0.16% above strike of the put that I sold, so I may be a proud owner of DIS soon.

DIS is sinking like a rock in water. I thought about buying it a month or so ago when it was ready to announce earnings and then I read about the political stuff and chickened out. I think it was around $150 at that time and down from the $180's.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well I ended up taking a little more than a nibble... Well actually several nibbles yesterday and today... (DCA'ing) Not a lot like last week but still some nice chunks of CSCO, XOM and MSFT. (in that order) XOM did ok but if CSCO and MSFT continue to drop next week, I'll probably "double down" on both of them. Funny how I keep using gambling terminology in my trading.Started nibbling my way back in yesterday and now again today. But it feels different this time.

tenant13

Full time employment: Posting here.

DIS is sinking like a rock in water. I thought about buying it a month or so ago when it was ready to announce earnings and then I read about the political stuff and chickened out. I think it was around $150 at that time and down from the $180's.

Disney's IP is insane. I don't quite understand why there's so much love for all those infantile cartoons, movies and shows but the facts are that people enjoy them. The political stuff is temporary and I'm convinced it will have no influence on the long term well being of this company. I bought it at the latest dip and while I'm down now, I have less than zero worries.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The future of course doesn't care about our likes and dislikes. My general opinion of media entertainment companies doesn't change the future.Disney's IP is insane. I don't quite understand why there's so much love for all those infantile cartoons, movies and shows but the facts are that people enjoy them. The political stuff is temporary and I'm convinced it will have no influence on the long term well being of this company. I bought it at the latest dip and while I'm down now, I have less than zero worries.

We received DIS shares by virtue of inheriting FOXA a few years back. DIS has done well, but plenty of headwind. For now I'm confident they will weather what's ahead. Their market is younger individuals, and I know that is a segment that is misunderstood here, and sometimes derided. But that is the future market DIS grows into, and I have no problem with the strategy. You can flip to the Disney stream and feel safe about it, like we used to do with public broadcasting. My 35-something kid watches the movies. DIS is not going away.

As the stock price gets closer to $100, We'll add, maybe double our position. Sames goes for WBD. Netflix worries me. Hearing significant complaints and dropping of service.

YMMV.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well I bought a good bit more XOM, and a little more MSFT and CSCO today.... Still have some room but I'm getting close to my preset limits on all three. If all of these go back anywhere near their recent highs I'm going to be a happy camper.

Last edited:

aja8888

Moderator Emeritus

Well I bought a good bit more XOM, and a little more MSFT and CSCO today.... Still have some room but I'm getting close to my preset limits on all three. If all of these go back anywhere near their recent highs I'm going to be a happy camper.

I bought a small position in OXY as they announce earnings tomorrow night. Also picked up AAPL @$152 and immediately sold a covered call on it.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

It's hard to decide. Stocks that I think are at a nice valuation, I already have plenty. I would hate to keep adding to my existing positions, because if I am wrong, that just hurts like crazy when the market recovers and they don't.

So, I have to look at adding new positions. This requires me to do more work to investigate.

PS. For market timing in extreme situations, just buying the index can work wonder. Perhaps I will wait to do just that.

So, I have to look at adding new positions. This requires me to do more work to investigate.

PS. For market timing in extreme situations, just buying the index can work wonder. Perhaps I will wait to do just that.

Last edited:

I have finally feeling the pain of this down draft and it is affecting my appetite for equities.

I almost doubled my position in PLTR today and bought 10 shares of TSLA.

At this point I might be stopping buying for a while, but I did open a 20 share position in VTI and plan to add more if I think the bleeding will stop soon.

I might add to my tiny position in gene editing stocks, which has been brutally hammered or maybe some ARKG.

But I am getting close to going back into my shell until this is over.

I keep thinking how ironic it is that I was preaching the big crash for the past five years with mainly cash, only to start to increase equities when my prediction finally comes true.

I almost doubled my position in PLTR today and bought 10 shares of TSLA.

At this point I might be stopping buying for a while, but I did open a 20 share position in VTI and plan to add more if I think the bleeding will stop soon.

I might add to my tiny position in gene editing stocks, which has been brutally hammered or maybe some ARKG.

But I am getting close to going back into my shell until this is over.

I keep thinking how ironic it is that I was preaching the big crash for the past five years with mainly cash, only to start to increase equities when my prediction finally comes true.

copyright1997reloaded

Thinks s/he gets paid by the post

Added to VDE today and also OIH.

Both were down over 9% today. We shall see, could be a break in oil demand...or it could be because they are good sources of funds for folks looking to sell any winner they have to make up for losses.

Also nibbled on INMD and for my 19 year old XBI.

Both were down over 9% today. We shall see, could be a break in oil demand...or it could be because they are good sources of funds for folks looking to sell any winner they have to make up for losses.

Also nibbled on INMD and for my 19 year old XBI.

jr6035

Recycles dryer sheets

I'm buying about 20k more of O at these prices. Buying on the way down. Best dividend stock on The Street.

I have no plans to buy long stocks until inflation and the Fed start to reverse course. Recently I bought a bit more DRV and TTT (inversing real estate and treasuries). Time range wise, I would guess I will go long sometime within Q4 this year to Q2 next year.

Last edited:

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

looking at oils and drugs.

As investments...

As investments...

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

looking at oils and drugs.

As investments...

Drug companies have been taken out to the woodshed, beat on for 30 min, then buried, dug up, drowned, burned, then buried again.

Oil is still pretty high.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Drug companies have been taken out to the woodshed, beat on for 30 min, then buried, dug up, drowned, burned, then buried again.

Oil is still pretty high.

Yes. is hard. cheap relative to earnings, but of we enter a recession they will drop.

Also looking at long-term growth names that have fallen to earth.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Your thinking is similar to what I do with SCHG growth (IRA) and SCHD value (Taxable).It's hard to decide. Stocks that I think are at a nice valuation, I already have plenty. I would hate to keep adding to my existing positions, because if I am wrong, that just hurts like crazy when the market recovers and they don't.

So, I have to look at adding new positions. This requires me to do more work to investigate.

PS. For market timing in extreme situations, just buying the index can work wonder. Perhaps I will wait to do just that.

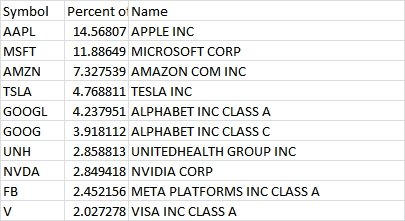

The top 10 are doing a lot of the work in SCHG.

Attachments

aja8888

Moderator Emeritus

Drug companies have been taken out to the woodshed, beat on for 30 min, then buried, dug up, drowned, burned, then buried again.

Oil is still pretty high.

AMGEN seems to have missed the carnage.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

AMGEN seems to have missed the carnage.

It is holding up ok, sure, but it was this same price pre-covid, so no net gain. Other drug companies have not held up as well.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Mine seem to have done well. Lilly, Merck, PFE, Abbvie.

Similar threads

- Replies

- 38

- Views

- 2K

- Replies

- 15

- Views

- 982

- Replies

- 10

- Views

- 947