You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

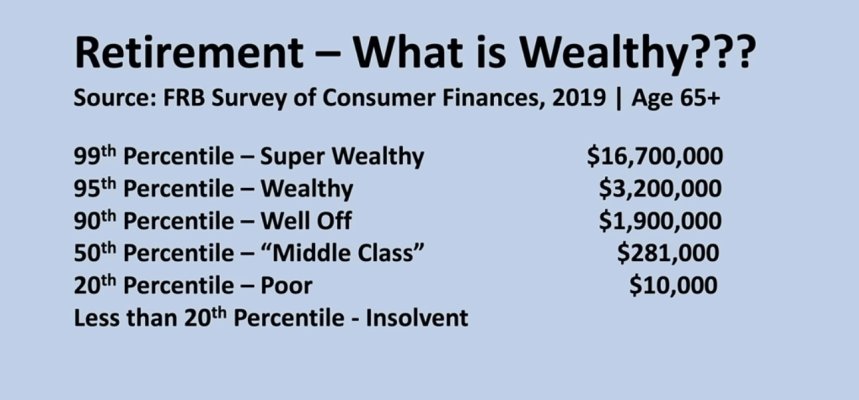

When Is A Retiree Considered Wealthy?

- Thread starter Midpack

- Start date

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I like Schmidt. I think the numbers in this are spot on. A lot of the folks on this site fall into the 95% wealth percentile. It is good to see a posting like this that does not focus on income to establish wealth as that is subjective for some retirees.

Last edited:

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

99th Percentile - Super Wealthy $16,700,000

95th Percentile - Wealthy $3,200,000

90th Percentile - Well Off $1,900,000

50th Percentile - "Middle Class" $281,000

20th Percentile - Poor $10,000

Less than 20th Percentile - Insolvent

This seems to be consistent with others things I have seen.

95th Percentile - Wealthy $3,200,000

90th Percentile - Well Off $1,900,000

50th Percentile - "Middle Class" $281,000

20th Percentile - Poor $10,000

Less than 20th Percentile - Insolvent

This seems to be consistent with others things I have seen.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Hi percentages of how many retirees fall into each category surprised me. I thought there would be less that he indicated.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Comparison is the thief of joy

Only if one is unhappy with their own situation. One can be in any of the above-mentioned categories and be perfectly happy, the reverse is also true.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Only if you let it. Comparison is something we can control. Comparison can be helpful and instructive.Comparison is the thief of joy

https://www.psychologytoday.com/us/blog/multiple-choice/201903/is-comparison-really-the-thief-joy

Last edited:

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,196

It usually depends on whether or not they have more than you  .

.

Andre1969

Thinks s/he gets paid by the post

Dumb question. Perhaps he said it, but for some reason my mind is glossing over it. Are those numbers he's posting threshholds, or the medians for those groups?

For instance, to be "Super Wealthy", is that $16.7M the point of entry to get into the top 1%, or is it the median net worth of the top 1%? I have a feeling that they're threshholds, but didn't know for sure.

Anyway, I'm hovering around $2.4-2.5M in investable assets. Throw home equity in there, I might get up to $2.8M. If I was to classify myself, I'd call it "Comfortable". Which, is about the same as "Well Off" I guess.

I dunno if pushing me to $3.2M would make me feel "Wealthy". But I wouldn't complain about it, either! Overall though, I'd say it was a well-rounded video.

For instance, to be "Super Wealthy", is that $16.7M the point of entry to get into the top 1%, or is it the median net worth of the top 1%? I have a feeling that they're threshholds, but didn't know for sure.

Anyway, I'm hovering around $2.4-2.5M in investable assets. Throw home equity in there, I might get up to $2.8M. If I was to classify myself, I'd call it "Comfortable". Which, is about the same as "Well Off" I guess.

I dunno if pushing me to $3.2M would make me feel "Wealthy". But I wouldn't complain about it, either! Overall though, I'd say it was a well-rounded video.

donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sucked me in. Always interesting. We are pretty high up but there sure seem to be a lot of folks living larger.  That said, I did just return home from a ten day biking vacation in the Italian Lake Country.

That said, I did just return home from a ten day biking vacation in the Italian Lake Country.

- Joined

- Apr 14, 2006

- Messages

- 23,113

I appreciate the effort he put into his video, and if he is an investment advisor, I can understand his focus on net worth, as he has an interest in getting to invest that money. But I think it would be a mistake to entirely disregard income. If a 65 year old married household had two secure pensions totaling $150k per year, they could live a pretty darned good life, even if they had minimal net worth. Especially if they also have social security coming in.

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I appreciate the effort he put into his video, and if he is an investment advisor, I can understand his focus on net worth, as he has an interest in getting to invest that money. But I think it would be a mistake to entirely disregard income. If a 65 year old married household had two secure pensions totaling $150k per year, they could live a pretty darned good life, even if they had minimal net worth. Especially if they also have social security coming in.

I’m pretty sure he’s a CPA, but he does very good videos.

Dumb question. Perhaps he said it, but for some reason my mind is glossing over it. Are those numbers he's posting threshholds, or the medians for those groups?

For instance, to be "Super Wealthy", is that $16.7M the point of entry to get into the top 1%, or is it the median net worth of the top 1%? I have a feeling that they're threshholds, but didn't know for sure.

I assume that since he is talking about percentiles that it is the threshold value, anything above that is included in that percentile. I.e., 90th percentile is everyone above $1.9M, 95th percentile is everyone above $3.2M etc.

Gumby's point is spot on, pensions could make a huge difference, I have none but wish I did. There would be more diversification in my income stream that way.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I decided to listen/watch the video and thought it was well done. Pretty good job as defining the difference between mean and median which folks still seem to get confused. Still a lot of open questions as to what is/should be included in net worth.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I decided to listen/watch the video and thought it was well done. Pretty good job as defining the difference between mean and median which folks still seem to get confused. Still a lot of open questions as to what is/should be included in net worth.

Assets - liabilities = net worth.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Assets - liabilities = net worth.

Exactly. However, lots of folks overestimate their assets and underestimate their liabilities. I can name 4 of our friends that do it. The home being a big one. We personally use what we paid, even though now it is worth double. I feel it is a more realistic approach. It is the only non financial asset we include in our calculation.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Exactly. However, lots of folks overestimate their assets and underestimate their liabilities. I can name 4 of our friends that do it. The home being a big one. We personally use what we paid, even though now it is worth double. I feel it is a more realistic approach. It is the only non financial asset we include in our calculation.

I use mark to market. To me that is reality. I don’t value my investments at what I paid for them, why should I do that for a house? We can see actual selling prices of homes around us. To extrapolate a per ft price is easy.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I use mark to market. To me that is reality. I don’t value my investments at what I paid for them, why should I do that for a house? We can see actual selling prices of homes around us. To extrapolate a per ft price is easy.

Same here.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Assets - liabilities = net worth.

Of course, but (in your opinion) are things like annuities, pensions, SS, life ins, etc, included in assets? Rhetorical, NNTR

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

He noted it was medians, and explained the difference between median and mean.Dumb question. Perhaps he said it, but for some reason my mind is glossing over it. Are those numbers he's posting threshholds, or the medians for those groups?

For instance, to be "Super Wealthy", is that $16.7M the point of entry to get into the top 1%, or is it the median net worth of the top 1%? I have a feeling that they're threshholds, but didn't know for sure.

Anyway, I'm hovering around $2.4-2.5M in investable assets. Throw home equity in there, I might get up to $2.8M. If I was to classify myself, I'd call it "Comfortable". Which, is about the same as "Well Off" I guess.

I dunno if pushing me to $3.2M would make me feel "Wealthy". But I wouldn't complain about it, either! Overall though, I'd say it was a well-rounded video.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Point taken - but income is not wealth, and he specifically said "wealthy." It's not a video about income security.I appreciate the effort he put into his video, and if he is an investment advisor, I can understand his focus on net worth, as he has an interest in getting to invest that money. But I think it would be a mistake to entirely disregard income. If a 65 year old married household had two secure pensions totaling $150k per year, they could live a pretty darned good life, even if they had minimal net worth. Especially if they also have social security coming in.

What’s the difference between income and wealth?

Income and wealth are both key indicators of financial security for a family or an individual. Income is the sum of earnings from a job or a self-owned business, interest on savings and investments, payments from social programs and many other sources. It is usually calculated on an annual or monthly basis.

Wealth, or net worth, is the value of assets owned by a family or an individual (such as a home or a savings account) minus outstanding debt (such as a mortgage or student loan). It refers to an amount that has been accumulated over a lifetime or more (since it may be passed across generations). This accumulated wealth is a source of retirement income, protects against short-term economic shocks and provides security for future generations.

Exactly. However, lots of folks overestimate their assets and underestimate their liabilities. I can name 4 of our friends that do it. The home being a big one. We personally use what we paid, even though now it is worth double. I feel it is a more realistic approach. It is the only non financial asset we include in our calculation.

+1

Only one difference. We purchased our home over 30 years ago. I've been adding to the original purchase price every year what we paid for property taxes and home insurance. Even adding both of those items for over 30 years and using that figure as our estimated value our property has more than doubled from that value.

Who says buying a home doesn't pay off.

Similar threads

- Replies

- 39

- Views

- 3K

Latest posts

-

-

-

Medigap Shopping: Closing the Book & Rate Increases

- Latest: sengsational

-

-

-

-

-