I've mentioned this little story before, but there's an episode of "Newhart", where the spoiled maid Stephanie goes home to see her wealthy parents, and bring her boyfriend, the yuppie/social climber Michael Harris. Michael is just blown over by everything he sees as the Vanderkellen estate, and like every other word out of his mouth is "WOW!"

The father, who I think was played by Jose Ferrer, said something along the lines of "Sometimes you forget to appreciate all the things you have, until you see them through the eyes of someone who is agog."

And, I think there's some truth to that. As your financial standing improves throughout life, you simply get used to it. And while a $3.2M net worth, for example, might not be normal across the general population, it will probably feel "normal" to YOU! And I don't think it means you're out of touch, necessarily. For instance, I realize, even at my relatively paltry ~$2.4M (plus home equity...I'm one of those that doesn't take it into account) puts me into a fairly lucky group. For instance, the next time the car breaks down, instead of whining about it and fixing it, I could afford to go pay cash for a new one. Most people probably can't do that. If I lost my job tomorrow, I'd be okay, and most likely would not look for another, and use that as an excuse to finally retire. Again, most people can't do that, either. If I really wanted to, I could upgrade this aging iPhone 7S with the latest model, and then replace THAT one with whatever comes out next. Oh, wait, that one's not a good example...I know plenty of less well-off people who do that, and it's one of the things that keeps them poor!

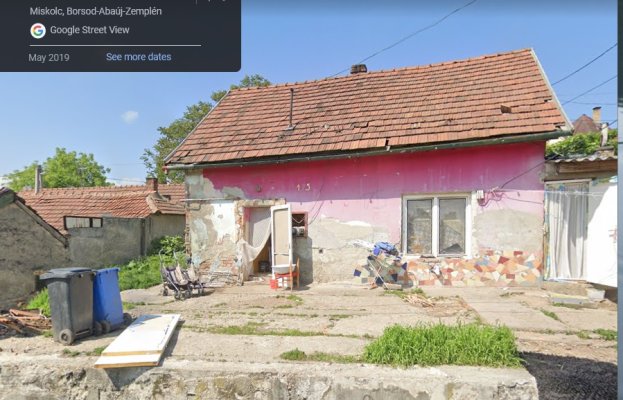

To me, being out of touch would be asking someone with an older car that just broke down..."Why don't you just get a new one?" Or, if their neighborhood is going south, "Why don't you just move?" and so on. Stuff like that. Basically, thinking that if you can do it, why can't others? I think most of us, in the lower millionaire range, are probably in pretty good touch with the way things are. We realize that it's not the norm for most of the world. But, we've just gotten used to it, so it's normal to US.